Bitcoin's mining centralization problem (Hashrate ≠ Freedom)

Hashrate ≠ freedom. Templates = freedom. Until miner-templating is common and censorship correlation breaks, rising hashrate is mostly optics.

One of Bitcoin’s biggest problems is mining centralization.

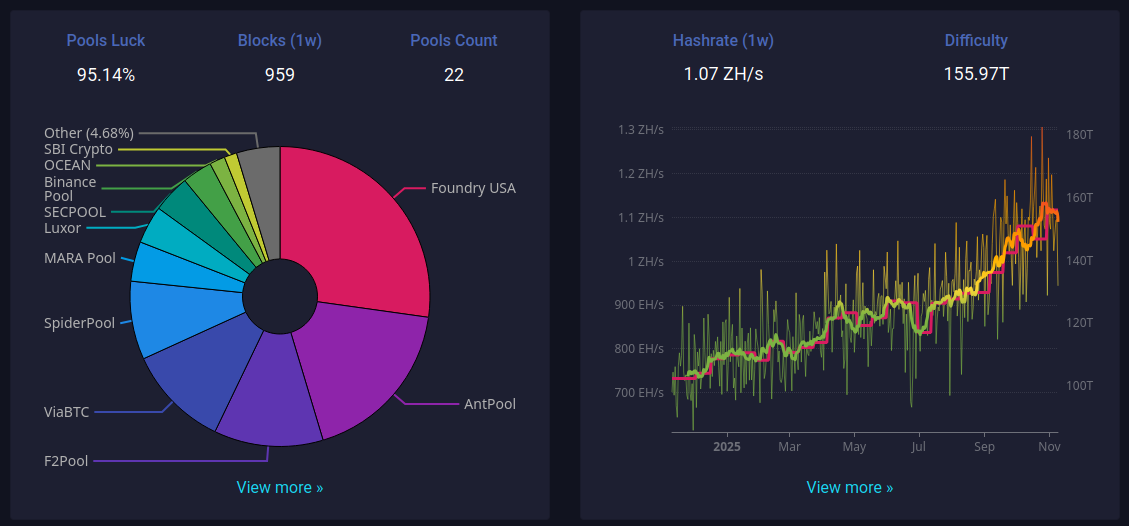

Hash power is coordinated by a small number of mining pools. At times, the top 2-3 pools reach or exceed 51%.

You can look at the current statistics at https://mempool.space/mining.

These pools decide which transactions go into blocks by setting templates and policies — including filters, OFAC (Office of Foreign Assets Control) lists, and template upgrades.

Individual miners chasing predictable payouts delegate that power upstream.

As a result, a regulator only needs to influence a few pool operators, not thousands of ASIC owners.

Mining pools such as MARA and F2Pool have already done “OFAC-compliant“ Bitcoin mining (transaction censorship).

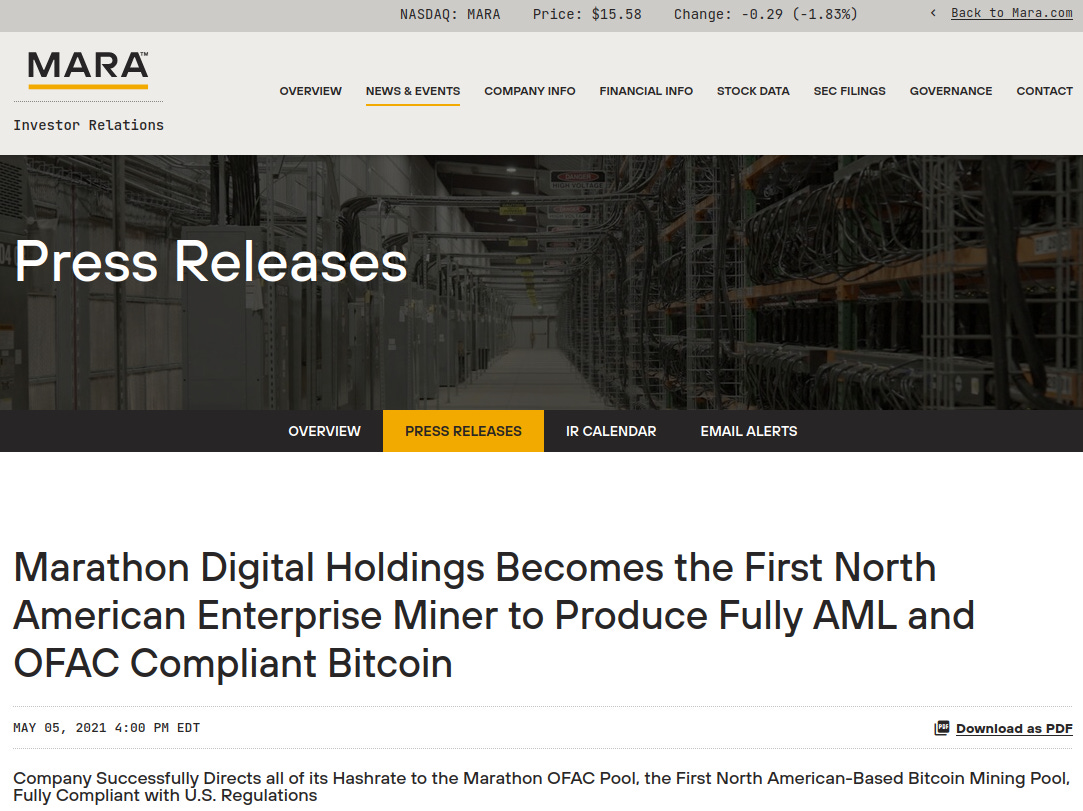

MARA (previously Marathon Digital Holdings) became the first North American Enterprise Miner to produce fully AML and OFAC-compliant Bitcoin.

Marathon abandoned the experiment within weeks amid industry backlash and to align with Bitcoin Core 0.21.1/Taproot signaling, saying they would validate like everyone else (no censorship).

A developer called 0xB10C caught F2Pool filtering transactions and their co-founder Chun Wang acknowledged:

Will disable the tx filtering patch for now, until the community reaches a more comprehensive consensus on this topic.

Chun Wang previously wrote (in a now deleted post):

Why do you feel surprised when I refuse to confirm transactions for those criminals, dictators and terrorists? I have every right not to confirm any transactions from Vladimir Putin and Xi Jinping, don’t I? Meanwhile, CZ is selling his soul for money. He deserves.

So both MARA and F2Pool have deliberately filtered OFAC-sanctioned transactions despite them having competitive fee related to all other added transactions.

Analyses of the first MARA “clean” block (height 682,170) focused on lower fees and excluded transactions. BitMEX Research noted the block contained ~0.0033 BTC less in fees than a normal maximized template would have, implying foregone revenue.

So these mining pools decided to lose fee revenue, trashed their reputation and eventually reverted to standard, non-censoring validation.

MARA is an American company while F2Pool is based in China, but somehow they’ve both done OFAC transaction censorship. I’ve already explained how this coordination works in a separate article.

The rivalry between China and the US is mostly theater, and that is one of the main reasons mining centralization is such a big problem for Bitcoin.

Unless a mining pool has adopted DATUM/Stratum V2, pools, not miners, decide which transactions get added to the blockchain.

Stratum V2/Ocean’s DATUM return control of block templates to the miners, so that miners, not pools, decide which transactions get added to the blockchain.

OCEAN is only about ~1% of total Bitcoin hashrate (order of magnitude; varies over time). If ~65–94% of OCEAN’s hashrate is on DATUM, that implies ~0.6–0.9% of the network hashrate is mining with DATUM today.

Stratum V2 is available at Braiins Pool and OCEAN/DEMAND’s pool, plus scattered tests elsewhere, but network adoption remains ~1% of hashrate or below.

In other words, Bitcoin mining is very centralized and increasing the hashrate without improving decentralization is mostly optics.

Executive summary

Bitcoin’s “decentralization” lives or dies at the template layer, not at hashrate.

As long as pools (not miners) pick transactions, the State can steer settlement via perimeter levers (power, banks, insurers, export controls, app-store rules, cloud/mempool policy).

Your headline metric is Effective Free Hashrate (EFH) — not raw hashrate.

Base case in a low Gross Consent Product world: soft censorship (risk-graded delays/fees, compliant fast-lanes) becomes normal; Bitcoin remains supervised Store-of-Value with controlled Medium-of-Exchange corridors unless miner-templating (Stratum V2 job negotiation / DATUM) reaches meaningful share.

1) Clean mental model

1.1 Layers that actually matter

Consensus layer: Validity rules; hard to capture without obvious forks.

Template layer: Which valid transactions get included now; easy to steer via pools & policy clients.

Perimeter layer: Power, capital, KYC rails, app stores, insurers, clouds, export controls; used to incentivize/compel templates.

1.2 Single sentence test

Security against reorgs scales with hashrate; censorship-resistance scales with who picks templates.

2) Pools vs miners: why the current topology drifts to compliance

Hashrate aggregation: 5–7 pools dominate; 2–3 often >51% combined.

Variance aversion: Miners prefer big pools for smoother payouts.

Payout plumbing: Pools integrate fiat/KYC rails and insurers — policy clients become the path of least resistance.

Result: Even with “rival” jurisdictions, interests converge around stability/insurance/permits → template steering spreads without a protocol change.

Template power: Pools choose txs. If large pools adopt blacklists/risk grades, blocks remain valid, but settlement is steerable (delay, deprioritize, fee-penalize).

3) Hardware & energy choke-points (why the perimeter wins)

ASIC oligopoly: 2–3 vendors, signed firmware, remote management, Return Merchandise Authorization (RMA) leverage.

Export/licensing: Customs and export permits can triage who gets new gen rigs on time.

Grid dependence: Industrial miners need interconnect, curtailment deals, environmental sign-offs; permits beat ideals in a low Gross Consent Product world.

Policy carrots/sticks: Cheap power for curtailment + ESG attestations / template policies; audits/penalties if “non-compliant”.

Result: If you need the power plant, the power plant owns you — and the State owns the power plant.

4) The only metric that matters: Effective Free Hashrate (EFH)

EFH ≈ Total Hashrate × Share using miner-controlled template selection (Stratum V2/DATUM, or non-custodial pools) × (1 − censorship correlation across pools).

Miner-templating share: where miners, not pools, construct/approve jobs.

Censorship correlation: probability two “independent” pools exclude the same tx set for policy reasons.

Interpretation: If EFH isn’t rising, the cost of censorship isn’t rising — no matter what Difficulty/EH/s says.

5) The perimeter’s steering wheel (concrete levers)

About ~1% of the network hashrate is mining with DATUM today. The numbers for Stratum V2 are similar.

So why aren’t we seeing wider adoption? The short answer is: because pools/miners are businesses and they aren’t incentivized to go against the system, nor do they have the leverage to.

Pools/Miners need the perimeters and the State can use these perimeters to punish/reward them.

Zoning, noise, water, interconnect queues, carbon accounting can choke miners without saying “Bitcoin” once.

Energy & siting

Interconnect queues, environmental sign-offs, demand-response credits tied to attestations.

Carbon accounting / Renewable Energy Certificate programs — discounts for “compliant” miners.

Capital & fiat

Bank accounts for pools; Suspicious Activity Report triggers on non-KYC payouts; auditors require policy evidence.

Trade finance for ASICs; insurers insist on template policies to underwrite downtime/legal.

Supply chain

Export licenses & customs prioritization for “certified” operators; firmware signing keys.

Relay/mempool

Cloud providers’ Acceptable Use Policies; relay networks with “risk-screening”; default clients nudged to policy mempools.

Statutes

Safe harbors for “certified policy clients”; if you don’t run one, you “own legal risk”.

Tax policy: accelerated depreciation/credits for compliant ops; audit focus for others.

Net effect: Soft censorship becomes cheap to enforce, expensive to resist.

6) Baseline scenario tree

Base case (55–65%) — Soft Transaction Censorship Normalized

Risk-graded inclusion (delays/fees), KYC fast-lanes, “we follow law” pool posture. Effective Free Hashrate flat to down unless miner-templating spreads. Bitcoin = supervised Store-of-Value, controlled Medium-of-Exchange corridors.Bear case (15–25%) — Policy Clients as Default

Insurers/utilities codify policy clients; major pools converge on common exclusions; non-KYC payouts de-banked. Effective Free Hashrate declines despite ATH hashrate.Bull case (15–25%) — Miner-Templating Breakout

Non-custodial pooling and job negotiation hit double-digits %; correlation falls; Effective Free Hashrate rises; censorship cost climbs. Requires clear legal shields + miner UX parity + payouts without KYC friction.

7) What a Controller would do (step-by-step)

Nudge defaults: app stores flag non-KYC wallets; clouds prefer “risk-screened” relays.

Codify insurance: pool/power insurers require policy mempools for coverage.

Tie subsidies: curtailment credits & siting permits gated on template attestations.

Offer safe harbor: “Run certified client ⇒ presumed compliant”.

Tax advantage: accelerated depreciation for certified miners; random audits for rebels.

Public story: “Stopping scams/CSAM/terror finance”. Quietly publish nothing on tx inclusion stats.

8) Why more hashrate can still be “fake comfort”

Reorg risk ↓ with EH/s, yes.

Censorship cost stays flat if template control stays centralized and correlated.

Outcome: headlines say “record security”; reality = steerable settlement.

9) Anticipated counter-moves (and why they’re weak unless incentives change)

“Miners will vote with their feet.” → They already did: into big pools with better variance/pay.

“Open-source fixes exist.” → Adoption follows payouts, support, legal comfort, not GitHub stars.

“Competition between countries saves us.” → Interests converge on stability/insurance; regulators copy each other; insurers are global.

10) TL;DR

Hashrate ≠ freedom. Templates = freedom.

Until miner-templating is common and censorship correlation breaks, rising hashrate is mostly optics. Measure Effective Free Hashrate (EFH), not Difficulty, and assume soft censorship as the base case in a low Gross Consent Product world.

In other words, with today’s pool topology and perimeter levers, large pools are likely to adopt OFAC/blacklist-style templates (explicitly or implicitly). Without miner-level template control becoming mainstream, more hashrate mostly strengthens the appearance of security, not the censorship-resistance we actually care about.

Note: I am not saying that hashrate is irrelevant.

Security against reorgs/51% still scales with hashrate. That’s not irrelevant.

Censorship-resistance does not if template control remains centralized.

So: marginal hashrate under the same pool topology is mostly irrelevant for freedom. Marginal hashrate under miner-templating topology is highly relevant.

You can read more about the DATUM protocol on OCEAN’s site.

More context on Bitcoin’s centralization issues: