Is Quantum Computing a threat to Bitcoin (my take)

Quantum Computing will have a serious impact on Bitcoin even if large-scale, fault-tolerant quantum computing is impossible (is not cost-effective relative to classical accelerators).

Since Bitcoin went mainstream, it has had a black cloud over it, especially in the post-ETF era.

Usually when an error-asset such as Bitcoin gets co-opted, you have a period of outperformance (post-regulation pump) — people are rewarded for doing the controllable thing and associate regulation with fiat price increase so that they ask for more regulation.

This is the classic “Honeymoon → Normalization → Harvest“ playbook.

New financial tech follows the same arc: big sweeteners at launch, normalization once everyone is on board, and then the quiet fee/tax/regulation harvest.

Where Bitcoin is: We finished the honeymoon (ETFs, easy brokerage access). We seem to have finished the normalization phase (more rules, fewer wild spikes). Harvest is next (nickel-and-diming self-custody; paper exposure everywhere).

The incentives flip as soon as enough users are corralled.

From the Bitcoin Core v30 fiasco, to the massive paperization, to privacy-preserving software attacks, to the Quantum FUD, it doesn't end.

This year is likely going to be another down year in fiat terms as liquidity is not as abundant and some pain is needed before the reflation of 2027-2028.

However, what gives me pause for the next bull market is the Quantum FUD.

I am not going to speculate on whether Quantum is:

not cost-effective relative to classical accelerators,

Quantum is going to be here in X years,

or the Controllers already have access to Quantum/similar technology.

As of now, it is unclear whether it can be engineered to scale cheaply and reliably enough to be broadly useful.

Even if you read official narrative textbooks, they tell you there are engineering uncertainties:

Overhead: how many physical qubits per useful logical qubit (and per useful algorithm run) once you include routing, measurement, decoding, and fault-tolerant gate synthesis.

Manufacturing yield and stability: can you fabricate and operate millions of qubits with acceptable error distributions and calibration costs.

Economic competitiveness: is Quantum cost-effective relative to classical accelerators.

For a moment, let’s assume that they are persistently unable to achieve this pattern over time:

as devices scale, logical performance fails to improve with increased error-correcting redundancy, or

the required control/cryogenic/readout complexity grows faster than any plausible engineering curve.

That would mean scalable fault-tolerant quantum computing is economically (or operationally) non-viable.

Do you think they’d come out and say this, or do you think they’ll continue to milk the Quantum threat?

Viruses have never been isolated, so Covid literally didn’t exist, but you already saw what happened during the scamdemic.

Is Quantum FUD in the cards for Bitcoin?

As of Nov. 6, 2025, DARPA has selected 11 companies to enter the second stage (Stage B) of the agency's Quantum Benchmarking Initiative (QBI), which aims to rigorously verify and validate whether any quantum computing approach can achieve utility-scale operation — meaning its computational value exceeds its cost — by the year 2033.

As far as I'm aware, they'll release their conclusion on whether this is doable by 2033 at the end of 2027.

ML-KEM (key encapsulation, based on CRYSTALS-Kyber),

ML-DSA (signatures, based on CRYSTALS-Dilithium),

SLH-DSA (hash-based signatures, based on SPHINCS+).

Open the National Security Strategy of the United States of America and Ctrl+f for quantum.

In the “What do we want in and from the World?“ section → “We want to ensure that U.S. technology and U.S. standards — particularly in AI, biotech, and quantum computing — drive the world forward.”

The page ends with: “These are the United States’ core, vital national interests. While we also have others, these are the interests we must focus on above all others, and that we ignore or neglect at our peril.“

“The United States must at the same time invest in research to preserve and advance our advantage in cutting-edge military and dual-use technology, with emphasis on the domains where U.S. advantages are strongest. These include undersea, space, and nuclear, as well as others that will decide the future of military power, such as AI, quantum computing, and autonomous systems, plus the energy necessary to fuel these domains.”

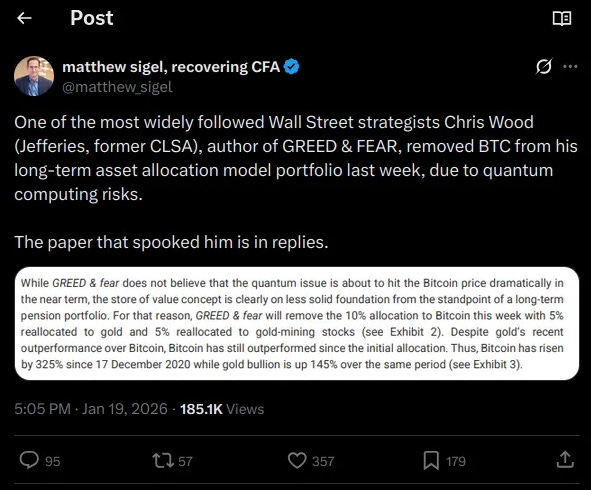

Institutional investors read these official narrative papers and take them into consideration when investing.

“One of the most widely followed Wall Street strategists Chris Wood (Jefferies, former CLSA), author of GREED & FEAR, removed BTC from his long-term asset allocation model portfolio last week, due to quantum computing risks.”

Luke Gromen also talked about Quantum being a risk for Bitcoin which is one of the reasons that made him sell some of his stack last year.

My point is not “Quantum breaks Bitcoin”, my point is even if Quantum cannot be engineered to scale cheaply and reliably enough to be broadly useful, we are likely still going to take some pain, at least in the short-term.

In the short-term on Quantum FUD, Bitcoin is going to take a serious hit in fiat terms.

We were expecting a rotation from Gold to Bitcoin, but are we going to get a rotation from Bitcoin to Gold?

Containment via Quantum-Upgrade Narrative

My base case is "Containment via Quantum-Upgrade Narrative":

QBI conclusion says "yes, utility-scale by 2033 is plausible; you must migrate"

Controllers lean into "Quantum Threat" as:

wedge to accelerate AI governance spending,

justification to herd BTC into regulated custody,

PR shield for post-ETF containment ("it's not us, it's quantum risk").

Custodians/ETFs run marketing:

"We offer quantum-safe storage; your coins are managed through PQ-hardened key ceremonies".

Regulators:

require regulated custodians to maintain PQ migration plans,

treat self-custody as "buyer beware".

In the short-term (2027–2028), from whatever level we're at (call it 1.0), a 30–60% drawdown purely on "quantum panic + macro/liquidity context" is very plausible.

In the medium-term (2028–2030), as soon as a credible technical migration path is visible and big institutions signal "we're staying, just upgrading", the existential discount shrinks.

BTC re-rates from "maybe doomed" back to "risky but fixable".

You get the classic pattern: puke on fear → grinding recovery → overshoot on "Bitcoin 2.0 is now quantum-safe" hopium.

Long term (2030–2033): deeper capture, not death, but Economic majority of BTC volume flows through:

ETFs,

banks,

large custodians,

tokenized wrappers,

all of which manage the PQ upgrade off-chain or via tightly controlled on-chain transactions.

Raw self-custody survives, but:

more legal risk (especially if running your own PQ-upgrade scripts is framed as "technical / risky / maybe non-compliant"),

more friction (fewer venues/service providers for direct UTXO control),

more social pressure: "only cowboys hold unwrapped BTC".

Even if the Controllers have access to Quantum/similar technology, it'd be massively counterproductive for them to nuke BTC.

Concretely:

1) BTC is already semi-captured.

Spot ETFs,

futures dominance,

KYC on-ramps,

chain surveillance,

regulatory moat around compliant custodians.

2) BTC is a useful:

volatility sink,

laboratory for financial engineering,

avatar for "freedom" that can be carefully corralled,

bargaining chip in geopolitics.

3) Killing BTC via quantum:

disrupts an asset many normies and elites now hold,

exposes secret QC capabilities,

destroys a functioning lab for vol management and product design.

The rational move for the Controllers is:

milk quantum threat for budgets and rails,

use it to push BTC deeper into containment rails,

oversee (and gate) a "quantum-safe" BTC upgrade,

keep the asset alive but more tightly coupled to policy plumbing.

Not:

show off Shor by nuking a globally relevant, heavily surveilled store of wealth that they already partially control.

However, because Quantum FUD is such a perfect obfuscation layer for post-ETF containment, any BTC under-performance can be blamed on “Quantum risk”, not:

corridor management,

macro liquidity.

In my view, even if we assume that Quantum can be engineered to scale cheaply and reliably enough to be broadly useful/they already have similar technology, it is not the end of BTC; it’s the next big excuse to reshape who is allowed to hold it, how, and under which rails.

"Quantum threat" justifies:

huge cyber / PQC / cloud modernization budgets,

new standards and certifications (PQC-ready, quantum-safe HSMs),

more identity / provenance rails ("we must re-key the entire planet cleanly").

The AI governance build-out loves Quantum.

"Quantum threat" is perfect:

plausible,

techy enough that voters can’t check the math,

slow-burn enough that it justifies recurring funding.

The optimal Quantum FUD level

High enough to:

force migration to PQC on their timetable,

centralize more trust in certified rails (clouds, HSM vendors, ID rails),

justify new oversight over keys and identities.

Low enough to:

avoid visible systemic panic,

avoid triggering mass exits from digital rails into physical cash / gold in a chaotic way,

keep a gap between what they privately know about timelines and what the public thinks.

The Quantum FUD gives the Controllers three additional tools in the containment corridor project:

1) "Safety" gating for self-custody. They can say:

"Old addresses and self-managed wallets are quantum-vulnerable".

Policy response:

deadlines where old UTXOs must be moved to "quantum-safe" wallets,

those wallets being KYC'd, tied to regulated custodians, with PQC migration controlled centrally.

2) Narrative for favoring paperization:

"ETF/ETN custody is quantum-ready; your coins in random cold storage are not".

This skews flows further toward paper BTC, reinforcing containment.

3) Justification for freezing / clawing certain coins. In the name of "protecting" users,

they can push for freezing or heavily scrutinizing coins that:

stay at vulnerable addresses,

belong to sanctioned clusters,

or are suspected of being tied to adversarial actors.

Quantum risk becomes the moral cover ("we had to step in to stop massive thefts").

(Without even proving whether it can be engineered to scale cheaply and reliably enough to be broadly useful)

Net: Quantum FUD is not used to "kill BTC"; it's used to:

accelerate KYC and custody centralization,

justify new rounds of "for your safety" rules,

and make the corridor narrower and more supervised.

You can be sure that JP Morgan stablecoin and CBDCs will be quantum-ready.

CBDCs eventually get sold as:

"the only truly quantum-resilient, state-guaranteed digital money".

PQC is part of their sales pitch:

"We've built post-quantum security from the ground up; you don't need to worry".

Quantum is just another argument (and a great one at that) to push people off raw, permissionless rails and onto regulated, programmable rails.

If Quantum computing progress disappoints (because it is uneconomical or for any other reason):

Nobody will loudly admit "we overreacted"; the PQC migration and centralization are sticky.

Quantum FUD will be retrofitted into:

We prudently prepared; even if quantum is slower than we thought, those defenses improve cybersecurity anyway".

Quantum is just another "problem → reaction → solution" loop

Problem:

theoretical quantum decryption threat.

Reaction (we are here 👈️):

fear, funding, think-tank papers, QBI reports.

Solution:

centralized, PQC-certified rails,

expanded ID and audit infrastructure,

marginalization of DIY cryptography and permissionless rails.

Quantum FUD is the narrative wrapper for a control + procurement supercycle that was coming anyway.

It's basically a justification for:

heavy AI/HPC capex ("we must simulate, benchmark, and defend"),

stricter ID/provenance rails ("we must know who is who as we re-key everything"),

more invasive endpoint controls ("legacy clients & wallets are a national security risk").

I don't know why Gold has gone up as much as it has in fiat-terms (though I have some assumptions), and how much of it has to do with this Quantum script we are about to experience.

About a year ago, I slept like a baby with 98% of my net worth in Bitcoin.

There’s no way I could do that with what I know now.

Of course, getting wrecked by inflation is not an option either, so I’ll probably write some more articles on what my current views are in other articles.

A very painful tail case for the next bull market (e.g. 2027-2029) would be for the Controllers to use Quantum FUD as the excuse for massive AI governance spending (the Big Print) and for Bitcoin to sit most of it out because it's being omega fudded by official narrative papers and Quantum experts.

By pure luck, I sold most of my stack last year because of the Core v30 fiasco which prompted me to do some more research.

We've practically been getting cucked since Oct. 10th — watching everything run (in fiat terms) except for Bitcoin.

The official explanation of course doesn’t add up, but at this point, Bitcoin is not a pure liquidity play.

Bitcoin is a play on liquidity with regulatory overhang.

This adds a lot of complexity.

If this tail case (Bitcoin sitting out some/most of the Big Print) were to happen for most of 2028-2029, Bitcoin would become an absolute shit show.

Most of the hardcore Bitcoiners will have fled to Gold, real estate, land, Monero, etc., (assuming they haven't already) due to Bitcoin getting so captured and complicated in the post-ETF era.

Once the holderbase is more governable and Bitcoin looks more and more like Ethereum, they can pump the fiat price to the moon.

I don't think Bitcoin sitting out most of the next bull market is very probable, but predicting the future is hard.

Core v30 opening endless attack vectors, the Controllers clearly setting up a Quantum theater phase, all of this paperization, regulation, and centralization, makes Bitcoin a lot more complex.