How Central Banks deliberately cause crises and inflation

Central Banks under-inject liquidity by however much they want, whenever they want, to rug-pull whoever they want and bail out whoever they want.

In this article, I’ll expose the entire game of central banking.

I’ll expose how there is no solution from within the system and how humans are playing a game they can never win.

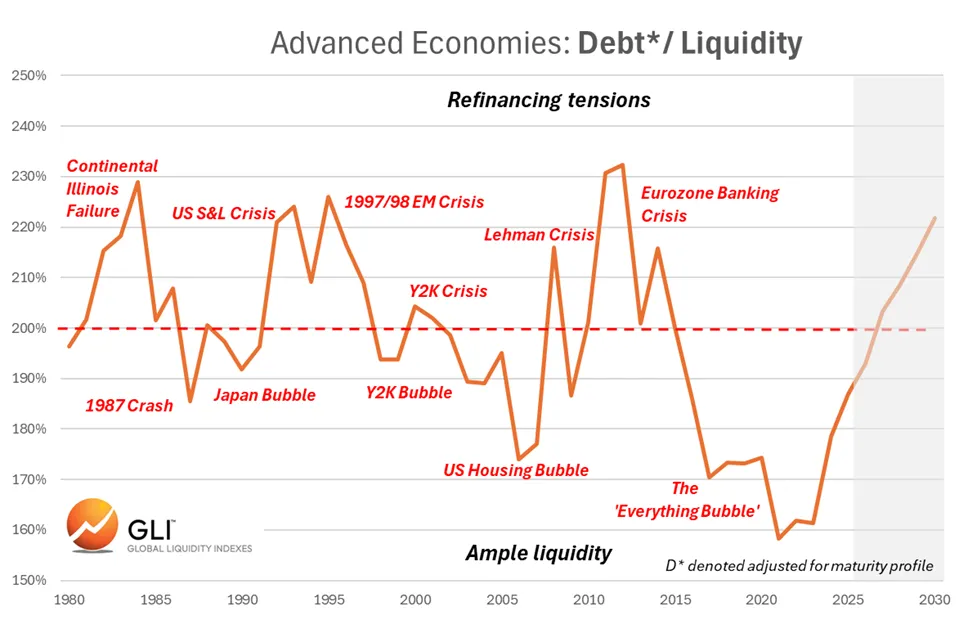

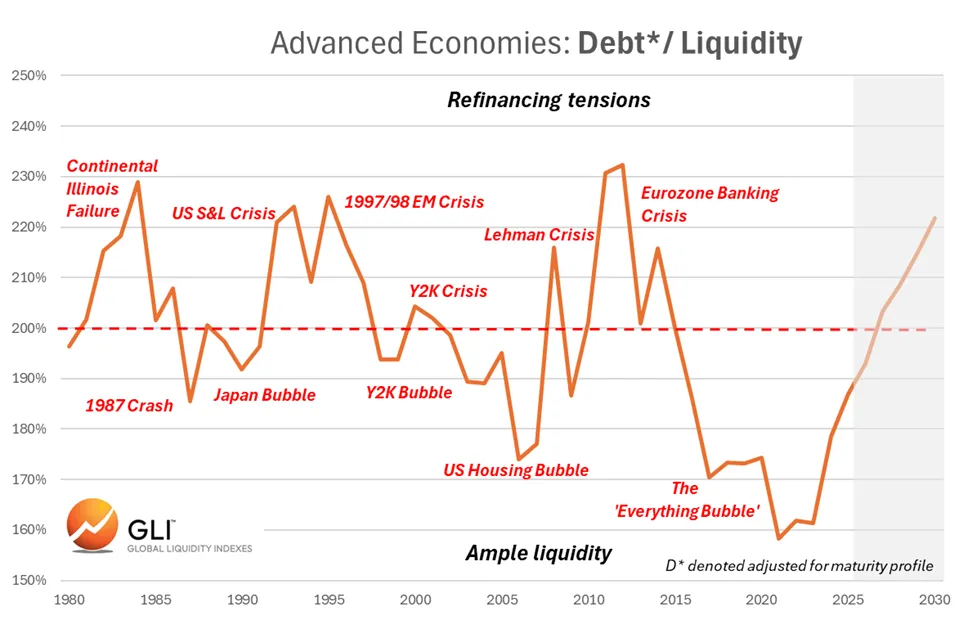

A while ago, I saw this chart by Michael Howell and it blew my mind and prompted me to do more research.

As he has stated in many of his interviews, the real cycle is Debt/Liquidity, not Debt/GDP.

Almost every "crisis" is: not enough liquidity, at the right points in the plumbing, to roll the existing debt at a politically tolerable price.

"Too much liquidity vs debt" → bubbles.

"Too much debt vs liquidity" → refinancing crisis.

In other words, Central Banks inflate the currency at will and rug-pull at will.

Richard Werner did a good job of illustrating this in his book and documentary “Princes of the Yen“.

Think of the global system as a giant refinancing conveyor belt:

The belt carries maturing obligations (bonds, loans, repos, margin).

The operators can spray liquidity foam (reserves, facilities, swap lines, fiscal deficits, regulatory relief) to keep things rolling.

If they over-spray, everything slides too easily → bubbles.

If they under-spray, some pile of debt sticks, catches fire, and they have to choose who burns.

Debt/Liquidity = how well that belt runs at any given time.

Debt/GDP is the fake, official narrative story (it is stock vs flow), whereas Debt/Liquidity is about timing and plumbing.

Every financial crisis is basically a roll failure (not enough liquidity to roll the existing debt at tolerable prices).

They can under-inject liquidity by however much they want, whenever they want, to rug-pull whoever they want and bail out whoever they want.

Each Debt/Liquidity cycle is another Hegelian loop:

Problem: refi wall + under-injection of liquidity → crisis.

Reaction: fear, political pressure.

Solution: more centralized rails (CBDCs, ID, Palantir-style governance OS, tighter collateral rules).

We're basically playing a game we can't win and have been for a very long time.

If you think in Debt/Liquidity terms, "macro" stops being a blur and becomes a timing overlay on top of a very stable structural direction: more debt, more crises, more patches, more rails.

Michael Howell does a good job of illustrating the Debt/Liquidity relationship with this chart.

"Too much liquidity vs debt" → bubbles.

"Too much debt vs liquidity" → refinancing crisis.

The world is one giant, segmented refinancing machine

The Controllers don’t care about “fair value”; they care about where roll failures happen and what they can harvest from each failure (rails, legal powers, collateral, obedience)

Liquidity is the throttle on that machine: over-spray → bubbles; under-spray → selective roll failure → crisis → more control

1. One global conveyor belt, many lanes

Extend the “refinancing conveyor belt” metaphor globally:

Lane A – Core Developed Markets (DM) sovereigns & banks

USD/EUR/JPY sovereign debt, G-SIBs, MMFs, primary dealersLane B – Strategic corporates / rails

Cloud, AI, ISR, cyber, energy/grid, CBDC/stablecoin, ID, Palantir-typeLane C – Domestic households (housing + pensions)

Mortgages, household credit, pension promisesLane D – Emerging Market (EM) sovereigns / corporates

Hard-currency borrowers, commodity exportersLane E – Shadow & periphery

PE credit, HY, structured credit, meme beta, alt L1s, fringe BTC leverage

Every few years, a big wave of debt hits the belt on each lane. If the same Controllers sit above the whole thing (US/Russia/China/Germany, etc.), then the game is:

“Given this global refi wall, where do we let roll failure show up, and what do we demand in exchange for a patch?”

That’s the Debt/Liquidity control loop in one sentence.

Spoiler alert: the people you see on TV are actors. They are not the ones making these types of decisions. They are the ones who sell you decisions that have already been made.

2. Debt/Liquidity as the real global policy rate

Debt/GDP is PR, Debt/Liquidity (DL) is the real instrument.

Imagine the Controllers literally thinking in these terms:

Global Debt/Liquidity (DL) ratio = “total maturing obligations (24–36m) / politically tolerable liquidity injection we can do without blowing up FX/inflation/legitimacy”

If DL is low (lots of liquidity vs small wall):

→ permission to over-spray → bubbles, carry regime, asset reflationIf DL is high (big wall vs constrained liquidity):

→ we must decide who burns and what we extract before patching

My line “they inflate at will and rug-pull at will” becomes:

Inflate at will: DL low → flood; refi everywhere; everyone feels richer.

Rug at will: DL high → withhold just enough liquidity at specific nodes so those nodes seize before others.

From that view, “monetary policy” is theatre; the real game is selective misalignment of Debt vs Liquidity components:

Misalign Emerging Markets before Developed Markets

Misalign periphery sectors before rails (Cloud, AI, ISR, cyber, energy/grid, CBDC/stablecoin, ID, Palantir-type)

Misalign retail wealth before pensions

So every “accident” is a choice of where to let the conveyor belt jam.

3. Crisis as planned mis-roll + negotiated patch

Under my assumption (same Controllers above US, Russia, Germany, China, etc.), a “crisis” looks like:

Identify a cluster where:

refi wall is heavy,

political leverage is desired,

and the pain is “socially acceptable” (or narratively spinnable).

Under-inject liquidity around that cluster:

Swap lines not extended (yet)

Eligibility not broadened (yet)

Auctions allowed to wobble

FX basis allowed to widen

Ratings agencies / IMF rhetoric tightened

Wait for roll failure:

Failed auctions / soaring yields

Sudden spread blowouts

Bank/sovereign doom loops

Margin spirals in associated assets

Offer the patch with conditions:

Legal reforms

Collateral pledges (land, SOEs, gold, strategic industries)

Governance changes (IMF programs, “independence”, surveillance upgrades)

Access-for-concessions in tech, bases, voting at the UN, Belt-and-Road, whatever

Spray liquidity selectively:

Enough to re-liquify the jammed lane

Done via facilities, swap lines, QE, regulatory forbearance

But structured so that ownership and control mix shift in favor of Controllers

Every “crisis” then is:

A deliberately induced or tolerated roll failure in a lane that is scheduled for restructuring + rail insertion.

Hegelian loop:

Problem: roll failure we subtly engineered (Debt/Liquidity misalignment)

Reaction: panic, political desperation

Solution: “assistance” conditioned on:

new digital ID, AML, tax/performance rails

opening markets to favored corporates

embedding Palantir-/MSFT-/rail-equivalents into core systems

4. Rotation of crises: why it feels random but isn’t

If the same Controllers sit above big blocs, you’d rotate where the big refi accidents happen:

Phase 1: Emerging Markets/local crisis

Under-inject USD liquidity to select EM bloc

Gain control over resources, ports, voting blocs, supply chains

Patch via IMF/CB swap lines, conditional reforms, debt-for-equity/resource swaps

Phase 2: Sectoral Developed Markets (DM) crisis

Let a DM sector with obsolete power (e.g. certain banks/industrials) take a hit

Use the crisis to:

force consolidation into “national champions” (Google, Microsoft, Amazon, Apple, Palantir, Nvidia, Tesla, etc.)

write stricter rules that small players can’t bear

embed new rails (KYC/ID/Palantir OS) as the “solution”

Phase 3: Periphery-of-core crisis (e.g. small ally, mid-size bank cluster)

Enough to scare everyone, not enough to break the system

Push through:

securitization rule changes

CBDC/stablecoin rails

cross-border data sharing, etc.

By rotating who gets rug-pulled, you avoid:

simultaneous global depression; and

noticeable pattern that would make “conspiracy” too obvious (e.g. as it became during the Covid scamdemic).

Visible randomness = design goal.

5. “We can’t win” = the refi treadmill is the game

As I already told you: We’re basically playing a game we can’t win and have been for a very long time.

Most participants are trapped on this treadmill:

Corporates refinance or die

Households refinance (mortgages, consumer credit) or downgrade life massively

Sovereigns refinance or face immediate regime risk

Banks refinance or become zombies/shut down

Debt is the hard constraint, liquidity is the soft dial. The dial is in someone else’s hand.

So:

When liquidity is abundant, everyone voluntarily steps deeper onto the treadmill (cheap credit, buybacks, leverage, mortgages)

When liquidity is withdrawn, those who took maximum advantage of abundance get wiped first. Watch Richard Wener’s “Princes of the Yen” documentary to understand what I mean

The treadmill never stops, because stopping = mass defaults, asset write-downs, and power reset

That’s why we can’t win at the macro level: the machine is designed so that the only way to function at scale is to keep rolling. And the Controllers are sitting at the dial, choosing:

Which lanes get 0% rates, facilities, QE

Which lanes get “market discipline” and rug-pulls

You can win as an individual/sub-cohort by:

moving closer to the dial (state-embedded rails — until they rug-pull with a Great Taking), or

stepping partially off the treadmill (self-custody, real assets, low leverage)

…but the majority is structurally forced to play.

6. Under-injection of liquidity as a weapon: the deliberate rug

As I stated earlier: “they under-inject by however much they want to rug-pull whoever they want, then bail out whoever they want”.

In the Debt/Liquidity model:

Under-injection is not “oops, we tightened too much”

It’s: We know the refi wall profile; we know who’s leaning on short funding; we know who has political capital and who doesn’t. We choose to be 50–150 bps “too tight”, or to let Net Liquidity run –$X for Y weeks, knowing that will cause a jam in a particular lane.

And because we’re in a low Gross Consent Product (consent scarce) regime:

They aren’t trying to run a 10-year depression.

They’re running short, sharp under-injection windows:

make an example

force consolidation

pass rules

embed rails

then patch

Under-injection is calibration:

Ratchet down liquidity until:

specific sector/region starts squealing,

but core rails + indices + key banks/pensions are still intact.

Then re-liquify just enough to avoid system collapse.

This is often the default play during the midterm US year (2nd Presidential year): Year 2 is the “discipline window” where under-injection compresses multiples but doesn’t intentionally blow up the entire system.

Michael Howell has shown this is some of his presentations.

7. If the Controllers run US/Russia/China/etc.: extra layer

I previously told you that the same Controllers run all blocs that matter (US, China, Russia, Germany, the UK, Japan, etc.).

Some would call this a One World Government, or “the new World Order“.

If we take my controlled-multipolar idea seriously, some “crises” across blocs might be:

Scripted blame games, real liquidity games.

Example pattern (not claiming a specific historical case):Sanctions + FX shocks “force” a country to issue debt at high spreads.

External funding dries up (under-injection of liquidity).

Crisis.

Then:

concessions in military basing, tech standards, commodity pricing

admission into some parallel rail (e.g. join certain CBDC network, give data access)

partial bailout via swap lines, direct/indirect QE, resource-for-debt, or quasi-Vulture deals.

In that picture, the conflict narrative is cover for:

reorganizing ownership and control of:

strategic resources,

trade corridors,

data & identity systems,

AI/compute + grid rails.

The “same Controllers” assumption gives you:

Roll failures as instruments of global rebalancing, not accidents. You don’t just “resolve” crises, you use them to adjust who is plugged into which rails and under whose terms.

8. Why the system still isn’t omnipotent

They aren’t gods.

Wrong estimate of Debt/Liquidity tolerance

They might misjudge how much liquidity under-injection a given wall can take → we get bigger than intended crisis (GFC, euro crisis, UK LDI style). They then have to patch more aggressively and concede things they didn’t plan (e.g., new populist rules, increased scrutiny).Foreign defection (very difficult and extremely unlikely)

If they push one bloc too hard, that bloc may:pivot to alternative funding,

build competing rails,

lean into BTC/gold/commodity-credit structures more aggressively.

(and get invaded)

Internal faction fights (mostly theater)

Treasury vs IC vs populist politicians vs asset managers can disagree on:who to sacrifice,

how much pain is acceptable.

Narrative/legitimacy accidents (mostly theater)

A “controlled” crisis can spark a narrative cascade (Occupy, Gilets Jaunes, 2016/2020 elections, populist surges) that worsens Gross Consent Product more than planned.

So their game is:

Try to manage global refi through staged roll failures and patches,

under real constraints: inflation, FX, foreign blocs, internal politics, limited state capacity.

And for when they fail, they preserve their right to rug-pull almost everyone with a Great Taking.

9. Ultra-compressed summary

If I compress the whole thing:

Assume the same Controllers sit above the main blocs.

The world is one giant Debt/Liquidity-controlled refi conveyor belt.

Crises = planned or tolerated roll failures at specific lanes to:

discipline,

extract concessions,

install new rails,

reshuffle ownership.

Debt/GDP is a story. Debt/Liquidity is the hidden control dial.

Over-injection = bubbles → justification for “never again” rules and supervisory upgrades (more rails).

Under-injection = rug windows → Hegelian loops (Problem → Reaction → Solution) that always add:

more digital ID,

more surveillance,

more “AI governance OS”,

more constraints on Medium-of-Exchange competition (Bitcoin, Monero).

Humans “can’t win” at the macro level because the treadmill is structural, but individuals can:

move closer to the dial (own rails) — until they get rug-pulled with a Great Taking,

partially exit the treadmill (self-custody, no leverage),

and time aggression vs defense with Debt/Liquidity, not press conferences.

Brilliant framework here. The Debt/Liquidity lens really cuts through the noise in a way that conventional macro analysis doesn't. I've been tracking refinancing walls in my own work and the calibrated under-injection point is spot-on, it's like watching the plumbing fail in slowmotion. The bit about selective mis-roll really made me rethink how I look at EM vs DM crisis timing.