All roads lead to Gold

The Controllers don’t really have many degrees of freedom left. Gold is the only asset that solves all of their problems at once without handing away control.

In a recent interview, Luke Gromen explained why he thinks “All roads lead to Gold”.

Definitely worth a watch. In my opinion, Luke and Michael Howell are the best in the business.

I’ll give you my take on why all roads lead to gold in this article.

I already largely explained the thesis in my “Why I think the government created Bitcoin (and a few predictions)“ article.

It should be noted that, as always, I am making assumptions that are not guaranteed to be correct, so I could be wrong on some/all of this.

In my opinion, the Controllers don’t really have many degrees of freedom left. Gold is the only asset that solves all of their problems at once without handing away control.

1. The problem the Controllers are actually trying to solve

Under my assumptions:

Freegold architecture (ANOTHER) is roughly right.

The Great Taking (collateral sweep via dematerialized custody + bail-in law) is a design feature, not a bug.

Low Gross Consent Product regime: consent is scarce, crises are frequent, patches are fast, pensions/housing/indices are sacred.

Put that together and the Controllers’ real optimization problem is:

Default on an unpayable debt pile in real terms

without:explicit “we defaulted” headlines,

full loss of fiat credibility,

systemic bank/pension collapse.

Rewire the reserve system for a multi-polar world

so:dollar hegemony is tempered,

but global trade/finance doesn’t fracture into chaos.

Tighten domestic control

via:KYC/AML/capital controls,

…while keeping some veneer of “free markets” and “rule of law”.

They cannot:

Let everything implode and say “oops, my bad”.

Let BTC become the sovereign reserve bedrock (too permissionless, too out-of-band).

Let any single bloc’s fiat be the neutral anchor (others won’t accept).

So they need something that:

Already sits on sovereign/CB balance sheets in size.

Is acceptable to all blocs as neutral wealth.

Can be revalued massively without rewriting every debt contract line-by-line.

Is physically finite and not under anyone’s IP regime.

Can be largely centralized in state/Central Bank custody before the big move.

That list basically selects “physical gold held by CBs” by construction.

“All roads lead to gold” = “given their constraints and goals, all plausible roads that don’t end in regime collapse require a gold plug somewhere near the base of the stack.”

2. Why gold and not anything else (under my assumptions)

You already know the physics/chemistry arguments (scarcity, durability, divisibility, stock/flow). More important in my frame is the institutional and geopolitical path-dependence:

2.1. It’s already sitting where they need it

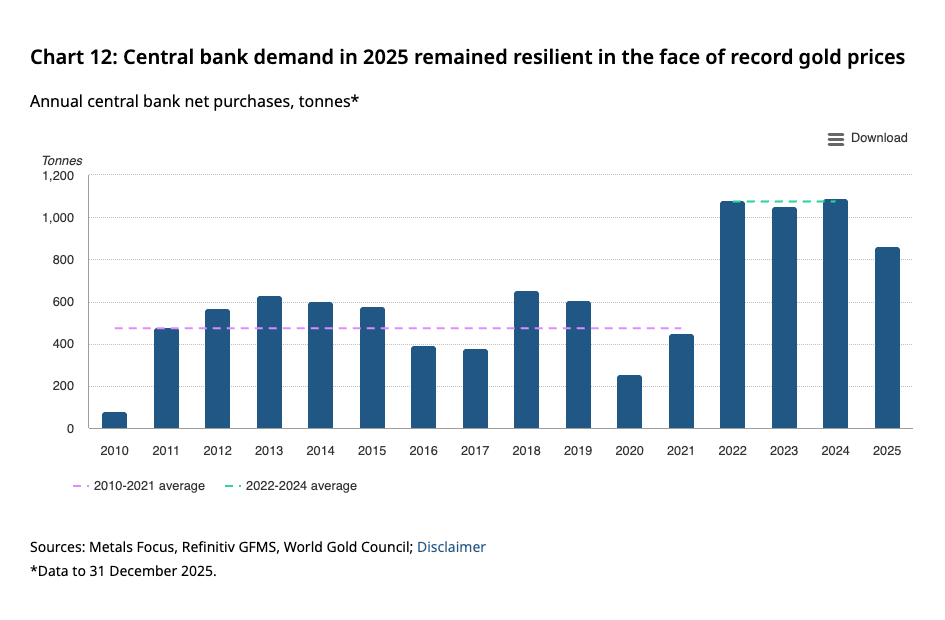

CBs already own thousands of tonnes, recognized as reserves.

The European Central Bank / Eurosystem already marks gold to market on its balance sheet — ANOTHER’s “Freegold skeleton”.

Post-1971 dollar system never got rid of gold, it just pushed it into the basement of the plumbing and pretended it was irrelevant.

So if you want an asset-side plug to fix sovereign/CB balance sheets, you don’t need to invent anything. You just let the price of the thing you already own move.

These are official statistics. There is significant unreported gold buying by Central Banks.

If you dig deeper, you’ll find that only a small portion of gold buying by Central Banks is reported, and usually mostly by Emerging Market Central Banks.

G7 can’t be seen stampeding into gold.

If you’re running the incumbent fiat+bond system (US, Eurocore), it is suicidal optics to visibly join the gold rush:

Bond market signal.

If the US or major euro Central Banks started aggressively buying gold, the obvious signal to foreign creditors and domestic savers is:

“We are preparing for currency debasement / reserve system change.”

That invites:

higher term premia,

faster foreign diversification out of your bonds,

“flight to metal” from your own citizens.

Domestic political signal.

The moment you say “we’re buying gold because it’s the ultimate money”, you implicitly admit:

“Your pensions and savings are sitting in a debasing unit we control.”

That’s a legitimacy grenade in a low Gross Consent Product regime.

Narrative conflict.

The official script still needs:

“fiat is fine”,

“the dollar/euro are stable reserve currencies”,

“gold is just another reserve asset, barbarous relic, diversification”.

If you visibly act like ANOTHER is right, you blow up that narrative.

So the optimal G7 behavior is:

Hold large reserves quietly.

Mark to market in Euro-architecture, but don’t talk about it.

Let others be the visible gold bugs.

Under my assumptions, G7 needs gold functionally, but wants gold to remain narratively invisible until it’s time to use it as a reset lever.

2.2. Gold is geopolitically neutral enough

US, Europe, Russia, China, India, the Gulf — all have significant gold.

No one can patent gold, sanction “gold protocol”, or push OS updates.

It’s the only thing where US hegemony is not embedded in the object itself.

Try alternatives:

USD: already the problem, not the solution.

Special Drawing Rights (SDRs) / synthetic IMF basket: still anchored in fiat; trust issues remain; needs something solid underneath to be credible in a crisis → back to gold.

Oil/commodities basket: volatile, politically weaponizable, logistically messy; you don’t want oil barrels as your revaluation plug on Central Bank balance sheets.

BTC: structurally adversarial to the legacy system and not concentrated in official hands; admitting BTC to the sovereign reserve core would be surrender, not optimization.

Only gold gives you:

Shared history of being “real money” in public consciousness.

Already-existing cross-bloc acceptance.

No single state’s logo printed on it.

2.3. It’s legally and operationally easy to revalue

You don’t need a new treaty that says “1 new currency = X units of something”. You just:

Keep fiat floating as now.

Quietly or openly stop sitting on gold via derivatives/lease games.

Let physical gold price rip, or engineer a step change (Freegold).

You’ve changed the unit in which sovereign/Central Bank asset strength is implicitly measured, without rewriting every bond prospectus.

Every other candidate anchor creates far more paperwork, dead-weight political fights, and “who lost?” narratives.

3. Where the Great Taking forces their hand toward gold

As David Rogers Webb exposed, Great Taking = “collateral sweep via legal plumbing and dematerialized custody, so the system keeps the real assets, and end-users get paper scars”.

Mechanically, that means:

Securities and “paper claims” (equities, bonds, funds, ETFs, including paper gold) are:

pooled in Central Securities Depository (CSDs)/Central Counterparty Clearing Houses (CCPs),

rehypothecated,

owned only as “securities entitlements” down the chain.

Resolution law (post-GFC) lets authorities:

freeze,

haircut,

convert those claims in a crisis;

while prioritizing CCPs, systemic banks, and CB operations.

So who ends up owning the underlying collateral after the Great Taking?

Sovereigns and Central Banks (directly or via resolution vehicles).

Systemic CCPs under regulatory control.

“Safe” core institutions.

That collateral includes:

“real” productive assets,

land and infrastructure,

and crucially, the physical gold that sat behind:

bullion bank unallocated accounts,

LBMA bar stacks,

ETF vaults,

term lending/leasing chains.

So:

Great Taking pulls real assets + gold upward into the sovereign/CB perimeter.

Private paper claims are haircut, bailed-in, converted to long-dated IOUs or CBDC credits.

Now that the underlying gold is in the “right” hands, you finally have the clean setup to run the Freegold move without sharing most of the upside with the masses.

The sequence:

Before Great Taking: revalue gold → lots of benefit leaks to ETF holders, unallocated accounts, “wrong people”.

After Great Taking: revalue gold → most uplift accrues to CB/sovereigns who now own a bigger share of true physical.

The Great Taking makes gold the natural end-state numeraire, because it strips away the messy, levered paper layers and hands the shiny core to whoever can actually enforce their claims in a crisis.

4. All the alternative “roads” still converge back to gold

Let’s take a few stylized paths the Controllers could choose and follow them until they hit their constraints.

4.1. “Just inflate it away” road

They try:

Persistent 3–7% inflation.

Financial repression (rates pinned below inflation).

No explicit gold move, just quietly trash the real value of debt.

Problems:

In low Gross Consent Product, obvious inflation hits housing affordability and basic goods → visible anger.

Foreign creditors (esp. non-US blocs) demand something real in exchange for holding your paper.

Domestic savers eventually demand a story for “what is this money anchored to?” beyond “trust us”.

To keep this path going, they eventually need:

A visible anchor narrative (“we’re not Zimbabwe”), and

A side asset to dump value into when they’re done inflating → something the state already owns in size.

That’s gold again. Freegold is just “inflate it away” with a hidden rail: you default in real terms while loudly claiming you restored soundness via re-anchoring to gold at a much higher price.

4.2. “Hard austerity + balanced budgets” road

They pretend to be serious and try:

Fiscal tightening,

Cuts to welfare/pensions,

High real rates,

Long QT.

In theory, this could slowly grind the debt ratios down.

But in this regime:

Low Gross Consent Product → sustained austerity = political suicide.

High real rates into a big refi wall = systemic defaults (sovereign, corporate, banking).

Once defaults cascade, you still need:

some credible asset to recap banks,

some peace offering to savers whose pensions got hit,

something to offer foreign creditors.

You’re back at:

“We’ve suffered, now we rebase the system on something real” → gold.

Use CB’s gold revaluation surplus to patch systemically important institutions and pretend it’s a “reward for discipline”.

4.3. “New SDR / BRICS / synthetic unit” road

They try to build:

IMF Special Drawing Rights (SDR) 2.0, or

BRICS “trade unit”, or

some kind of multi-currency basket unit.

Initially, maybe it’s just a index of fiat currencies or commodities.

But:

In every crisis, participants will want to know: “What’s the ultimate asset behind this? What do we get if the basket itself is distrusted?”

If the answer is “a claim on more paper”, that won’t fly once trust is shaken.

To make a multi-bloc unit stable, you need something all participants see as settle-the-tab-for-good collateral.

That again is gold — either explicitly (“redeemable into X grams”) or implicitly (“we guarantee this unit is backed by a pool of reserves that are mostly gold”).

Even if they don’t advertise “gold backing”, the internal reality ends up:

SDR/BRICS unit value is managed with reference to a pool where gold is a growing share.

Gold becomes the silent compass behind the basket.

4.4. “Let BTC be the global store of value” road

They won’t, but let’s follow it for completeness:

To make BTC the sovereign reserve anchor, the Controllers would have to:

Publicly admit they can’t control the monetary base anymore.

Accumulate BTC aggressively for reserve portfolios (competitively, against each other and against the public).

Accept that BTC settlement doesn’t require state-controlled rails.

That road:

Violates their core preference: control > fairness and stability > truth.

Hands a huge early-mover advantage to whoever front-ran them (non-state actors, rogue states).

Destroys the ability to weaponize monetary rails.

Under my assumptions, that’s not a road they choose voluntarily. BTC remains:

A leak,

A parallel hedge,

A grey rail for adversaries,

A volatility sink for surplus liquidity,

…but not the official peace treaty asset between big blocs.

Once you discard BTC as the main anchor (from their POV), the only game-theoretic stable anchor that all blocs can live with is gold.

I’ve already covered how the Controllers are trying very hard to push “deglobalization” after the Covid scamdemic that exposed our One World Government.

This is a large part of the push toward a neutral reserve asset theater instead of “trust me bro” paper.

We have some insane levels of coordination taking place for this “deglobalized” of a world. At least they’ll be using a neutral reserve asset.

5. Freegold as the “least-bad” resolution of three simultaneous traps

Given Freegold + Great Taking, gold is the Controllers’ least-bad solution to three overlapping traps:

Sovereign debt trap

Honest default is politically too costly; wholesale hyperinflation is politically too costly.

Solution: default in real terms by:

inflating moderately,

revaluing gold,

booking huge gold revaluation gains on CB balance sheets,

servicing nominal promises in devalued units.

Multi-polar trust trap

US dollar unipolarity is increasingly resented.

No one wants another country’s fiat as the new hegemon.

But they need a way to keep doing large-scale trade, energy flows, arms spending, etc. without constant FX tantrums.

Gold revaluation + Freegold structure allows:

Currencies float vs each other,

But inter-bloc settlement and long-term reserve diversification runs through gold.

Domestic legitimacy trap

Populations are increasingly aware the fiat game is rigged.

CBDCs + digital rails will be seen (correctly) as control tech.

You need some visible concession: “We’re putting something real under the system”.

A visible, dramatic gold repricing:

lets them claim they “listened” to sound-money anxieties,

gives savers a new narrative: “Your money is ultimately backed by real reserves”,

helps them sell CBDCs as “efficient wrappers over a sounder system”.

In that triple-trap context:

Not doing a gold revaluation = keep stacking pressure until something breaks catastrophically (currency crisis, war, disorderly default).

Doing it before a Great Taking = share too much of the uplift with private holders.

Doing it after a Great Taking = optimal: Central Banks get most of the uplift; private sector gets some crumbs via domestic gold holdings and higher asset prices.

So all roads that avoid full systemic collapse eventually lead to:

Great Taking (collateral sweep) → Freegold (gold repricing + new reserve equilibrium).

6. Where BTC and physical private gold sit in that picture

Within that architecture:

6.1. Physical gold, self-custody

It’s the closest private asset to the thing Central Banks are about to reward.

It’s also the hardest to sweep via the Great Taking because it’s not sitting in DTCC/Euroclear/CCP custody.

Controllers will:

attack via taxation, reporting, KYC’d dealers,

maybe offer “generous” buy-ins for CBDC/bonds,

use AML/leverage to make large trades annoying.

But:

Door-to-door confiscation at scale is a state-capacity and legitimacy nightmare.

So private physical remains a leak, not the main sacrificial target.

In their calculus, that’s acceptable collateral damage: a numerically small group gets a windfall; system survival is the bigger prize.

6.2. Paper gold stack

Futures, unallocated accounts, ETFs sit squarely in the Great Taking firing line.

They live in the rehypothecated securities/collateral system and are precisely what resolution regimes can freeze and repurpose.

In the reset, they become:

cash-settled at pre-revaluation or “stabilization” prices, or

converted into gold-linked CBDC units with caps and haircuts.

Paper gold is by design the sacrificial buffer. It is how they:

Socialize losses across savers,

Block most people from getting the full Freegold upside,

Harvest physical for official vaults.

6.3. BTC, Monero, self-custody

Sits in the “small expropriation-resistant hedge” bucket.

It benefits if:

the FX/sovereign/custody crisis is so bad that trust in fiat + CBs + gold promises collapses, or

Controllers botch Freegold rollout, or

political fracture inside blocs gets ugly.

Controllers will tilt the playbook so BTC is:

contained,

paperized,

Medium-of-Exchange-frictioned,

…but they can’t fully erase it.

So in the end-state:

Official rails: CBDC/fiat on top, gold at base.

Unofficial leaks: BTC, Monero and physical retail gold.

BTC, Monero are the “escape hatch of last resort” for those who don’t trust any state anchor anymore. But the road they design still has gold as the official terminus.

7. Why even if they try something else, the end-state keeps re-converging to gold

Let’s take a longer view: suppose they delay Freegold, fumble, run half-measures, and we cycle through:

more QE/QT theatre,

more CBDC pilots,

more capital controls,

more war/energy shocks.

Over a decade or two, what keeps happening?

Foreign Central Banks keeping buying gold as silent protest and hedge against USD.

Domestic savers in many countries quietly accumulate physical gold, BTC, Monero.

Every big crisis prompts talk about “reforms” and “soundness”.

In that world, even without a clean, scripted Great Taking + Freegold moment, gold keeps getting slowly repriced up in real terms as:

the thing states trust each other with when fiat trust thins, and

the thing individuals trust when they stop believing the official story.

So “all roads lead to gold” for two separate reasons that happen to be aligned:

Controllers’ optimization → they need an asset-side plug and neutral inter-bloc anchor.

Bottom-up revealed preference of foreign CBs and savers → they keep migrating reserves and savings into gold whenever fiat stress appears.

Freegold is just the moment those two lines intersect violently instead of gradually.

8. Where that leaves us in this taxonomy

Controllers / Liquidity meta-layer

Liquidity is the control dial.

The big “down-cycle + patch” where they cannot/don’t want to patch with more unanchored fiat is exactly where a gold re-anchor is the least-bad move.

When the refi conveyor belt jams badly enough that “patch with more QE” threatens FX/credibility irreparably, the next logical patch is:

Freegold (revalue gold, recap the system).

Midterm Year lens

Midterm discipline/under-injection is the rehearsal space; the big eventual crisis (when discipline + patch fails) is the natural slot for Great Taking + Freegold sequence.

If Freegold happens cleanly:

gold does most of the heavy lifting.

If they botch it:

BTC/Monero/physical gold become crisis convexity,

the “all roads lead to gold” path becomes messier, but the direction (gold > fiat in real terms) doesn’t change.

As always, I could be wrong on some/all of this.

I’ve provided more context on Freegold in my “Why I think the government created Bitcoin (and a few predictions)“ article.