What made me sell most of my Bitcoin a few months ago

I am not bearish on Bitcoin's fiat-denominated price. I am bearish on Bitcoin's odds of becoming mass MoE, and I am pricing the coordination tax.

I am not bearish on math. I am correctly pricing the coordination tax I’m going to write about later on in this article.

I am bearish on Bitcoin’s odds of becoming mass, non-custodial Medium-of-Exchange.

I also don’t have anything to sell to you. This is not a “buy my shitcoin, it’s better than Bitcoin” article.

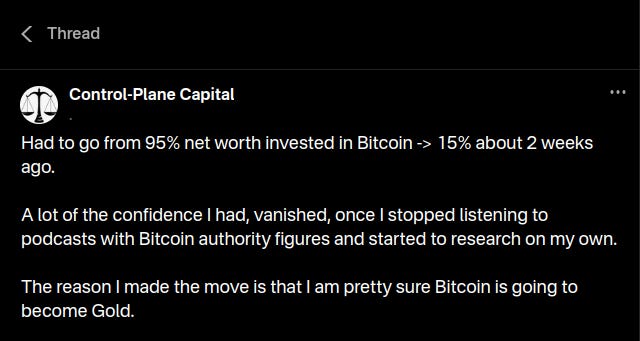

I still own Bitcoin, but demoted it to 15% (now probably more like 10% due to recent performance) of my NW from 95% a few months ago.

I demoted Bitcoin into a trade and a Great Taking scenario hedge.

I have a lot of things to write about in this article, so it’s going to be a long one.

You’ll understand just how important the community is for Bitcoin’s success (and why that’s a bad thing).

As I wrote in another article:

Bitcoin’s survival and adoption depend on whether its most committed users can detect, coordinate, and counter inevitable policy, market, and social attacks.

I am not particularly bullish on any community, but I’d be more bullish on a community that has a single goal and some courage than a community that is pulling in ten different directions.

Most Bitcoiners mainly focus on protocol-level truths. They don’t understand the perimeter capture rule and fall for the many misconceptions I’m going to write about later on in this article.

Before I get to the article, I’ll post one of my Nostr notes on here — some of my research on the biggest mistakes we Bitcoiners made as a community.

Instead of listening to podcast hopium and alienating people with “have fun staying poor” narratives, we should’ve focused on game theory and patched up at least some of the holes.

It was always inevitable that Bitcoin was going to get attacked, and things like having close to 100% of nodes run on a single implementation was just silly in hindsight.

People are doing more harm than good when posting charts of hashrate going vertical without the context that 2 pools (Foundry and Antpool) are close to 50% of hashrate and for more than 95% of cases, pools, not miners decide which transactions get added to the blockchain.

You had most of the Bitcoin community cheering price over payment share; we welcomed ETFs as victory. Paper share rose, self-custody fell.

The entire community also cheered Square’s surveilled “Bitcoin payments” where every payment generates identity-linked transaction data: buyer, location, device, and amount.

All transactions flow through Square/Cash App’s KYC/AML perimeter, meaning both sides of the payment are verified.

That data fuels risk scoring, fraud models, blacklist propagation, and targeted marketing.

Exactly this surveillance value is Square’s enduring moat, not the 1% fee.

We just got too complacent.

I’d say the 5 main mistakes we Bitcoiners made are:

Letting arbitrary data compete with money on the base layer (witness discount abetted it). For Medium-of-Exchange you need predictable fees; underpriced junk data is a Denial-of-Service subsidy.

Treating privacy as an “expert mode”. That guarantees surveillance wins by default. Make privacy invisible and automatic.

Under-investing in operational safety (backups, recovery, liquidity UX). Normal users pick custodians when scared.

Relying on norms over policy. In a low Gross Consent Product world, policy beats culture. If your mempool policies are naïve, adversaries will price you out.

Ignoring perimeter levers (app stores, banks, clouds). If you don’t plan redundant routes, the other side will plan your failure.

The uncomfortable truth is that Bitcoin’s defense can’t be “hope users pick hard mode”.

Defaults decide outcomes.

If Bitcoin wants to be mass Medium-of-Exchange, privacy, finality, recoverability, and predictability must be invisible and automatic — and the perimeter must be treated as hostile by default.

Until then, paper wrappers will dominate, regulators will “clarify”, and L1 will be priced as store-of-value with supervised access, not as everyday cash.

The good news: all of that is fixable — but only if it’s designed, not preached.

Why I demoted Bitcoin

Thesis shift: I didn’t turn bearish on math; I updated on power. In a low Gross Consent Product world, incentives > ideals, control > fairness, stability > truth. The perimeter (banks, app stores, clouds, pools, UX defaults, tax, custody law) is cheaper to steer than the protocol is to break.

Community dependence: Bitcoin’s survival as money requires its most committed users to detect, coordinate, and counter policy/market/social attacks. The median user won’t do that work, and elites don’t need to.

What I discovered (and why it sticks)

Protocol truth ≠ Social truth

Censorship resistance “on paper” loses to distribution choke points: KYC rails, wallet whitelists, pool templates, app-store policy, bank compliance, reporting defaults.Defaults beat ideology

Convenience rules. Users accept paper exposure (ETFs, custodians). Pricing power shifts to entities that can be steered.Coordination tax is real

Defense needs high-skill, high-time, high-stress volunteerism across clients, pools, wallets, legal, and comms — continuously. Attackers need one permissive knob.Containment playbook works

“Let price live, cap peaks, penalize self-custody payments, and celebrate ‘clarity’” → adoption without power transfer.

What that does to the Bitcoin thesis

From money to instrument

BTC trends toward supervised reserve/instrument (Store-of-Value inside custody), not everyday Medium-of-Exchange. It becomes tradeable volatility with paperization, not a parallel payments world.Shock convexity remains

In a Great-Taking-style seizure or banking break, self-custodied Bitcoin can gap up as “exit collateral”. That’s a tail hedge, not a base-case utility.Community is a risk factor

Governance by defaults (C2PA, Acceptable Use Policies, KYC wallets, node-liability scares) outpaces grassroots capacity to respond.

What would change my mind?

Bitcoin graduates from trade → system if ≥3 of these appear and stick:

Major wallets default to self-custody + Proof-of-Reserves.

App stores explicitly protect non-KYC wallets (policy carve-outs).

Large enterprises settle supplier payments in BTC on-chain (not through stables).

Pools adopt anti-filter client norms that resist insurer/utility pressure.

De minimis Medium-of-Exchange tax exemptions become global.

A high-profile custody failure permanently shifts users off paper.

If these don’t show up, the “trade + hedge” framing stands.

Why this disillusionment is rational (not emotional)

I updated on revealed preference: states will contain rather than empower; users will choose defaults over sovereignty.

Therefore, perimeter beats protocol in a low Gross Consent Product regime, and pricing follows the perimeter.

Bottom line: Bitcoin isn’t “dead”; it’s demoted — a cyclical trade with paperized carry and a disciplined self-custody hedge.

The Coordination Tax

Three Stacked Systems

S₀ Protocol: consensus rules, Proof-of-Work, supply.

S₁ Policy: relay/mempool defaults, mining templates, wallet behaviors.

S₂ Perimeter: banks, clouds, app stores, ISPs, payment networks, tax law, PR.

Security: S₀ is math; S₁/S₂ are sociotechnical.

Tax: recurring human + legal + distribution cost to keep S₁/S₂ aligned with S₀’s ideals.

Attacker asymmetry: One cheap perimeter tweak (Acceptable Use Policy line, bank heuristic, pool template) can shift millions. Defenders must hold all fronts, all the time.

Why S₀ strength can’t save S₁/S₂

Local vs global coordination: Miners, relay nodes, wallets, exchanges, banks, clouds, app stores, telcos, and tax authorities don’t share one incentive. A single perimeter actor flipping a switch (bank heuristic, pool template, app-store rule) moves millions of users in a day. Defenders must hold every front forever; attackers need one decisive lever once.

Defaults beat ideals: Users take the path of least friction. If default wallets rank KYC UTXOs, if exchanges block “tainted” coins, if pools adopt filtering templates, S₁ drifts away from S₀ without a hard fork — just through configuration and distribution.

Paperization gravity: ETFs, futures, custodial wallets, and stablecoin rails give the appearance of BTC exposure with zero S₀ habits (keys, fees, coin control). Capital migrates there automatically: cheaper compliance, fewer CFO headaches, friendlier UX. Result: price discovery migrates off self-custody.

Concrete choke points (how it actually gets steered)

S₁ — Policy layer

Relay/mempool policy: default size/weight filters, non-standard script flags, pinning/replace-by-fee knobs — tiny changes reprice whole classes of transactions; spam becomes “policy”.

Mining templates & pool policy: OFAC-style blocklists, template clients, or “ethical mining” scorecards throttle certain flows; hash is centralizing in a few pool coordinators.

Wallet behaviors: coin selection/labeling, change address treatment, default payjoin support (or lack thereof), fee estimator biases. Default UX narrows what the network effectively allows.

S₂ — Perimeter

App stores: one policy change can bury non-KYC wallets from discovery; “enterprise build” isn’t a mass-market workaround.

Banks & payment networks: Suspicious Activity Report (SAR) heuristics, de-banking of off-ramps, ACH/wire throttles.

Clouds/ISPs: ToS enforcement on archival nodes, block explorers, lightning relays; DPI throttles on known ports.

Tax/law: lot-tracking burdens, micro-tx taxation, reporting forms, travel rule on custodians; courts treat non-provenanced coins as higher risk collateral.

PR & narrative: “Safety”, “child protection”, “ransomware” frames ratchet Overton windows. Users self-censor.

What would have to change to upgrade BTC from “hedge” back to “system”

S₂ losses of control: capital flight events where banks/app stores/clouds are systemically seen as unreliable (not episodic).

S₁ renaissance: wallet defaults that make privacy the path of least resistance (automatic payjoin/coinjoin, decoy change, cross-input liquidity) and are distributed at scale despite store policies.

Merchant shield laws: statutory protections for self-custodial acceptance + tax simplifications (de minimis).

Pool decentralization with non-filtering social contracts (plus incentives for home hash).

Cultural flip: users value sovereignty over convenience at a mass level. Historically rare outside crises.

Why the attacker’s job is easier

Asymmetric cost function: Changing one default (e.g., “marketplaces must list only travel-rule compatible wallets”) costs a ministry one memo; defending requires thousands of open-source maintainers + wallet teams + exchanges + educators to respond coherently.

Short feedback loops: Acceptable Use Policies and risk memos push behavior this quarter. Protocol governance moves in years.

The Five Fronts (where defenders burn out)

Work: review/patch clients, police mempool, ship spam-resistant knobs without censorship handles, audit pull requests, maintain forks, steward BIP norms.

Why hard: deep expertise, zero comp, reputational crossfire.

Attack edge: one permissive relay/template outsources cost to the network.

Work: template diversity, resist filtering, monitor policy clients, non-custodial payouts, decentralize hash.

Why hard: legal pressure, business incentives; hash follows cheap energy + friendly jurisdiction.

Wallet & UX Sovereignty

Work: default-private, default-self-custody, node-aware wallets; app-store survival; inheritance/backup UX.

Why hard: legal/compliance + distribution negotiation; users prefer custodial ease; app stores can throttle.

Legal/Policy Perimeter

Work: litigate node liability, transmitter claims; comment on rules; push Medium-of-Exchange tax relief; defend Lightning/channel treatment.

Why hard: years-long fights, donor fatigue, low immediate payoff.

Social Consensus & Comms

Work: norms around soft forks, spam policy, inscriptions, fee defaults, client choice; counter coordinated media/legal campaigns; fund devs without capture.

Why hard: tribal splits, reputational warfare, infinite time sink.

Result: Offense needs one hole; defense must hold all five.

Cheap Perimeter Switches (why control scales)

App-store levers: throttle updates, scary prompts, ranking friction for non-KYC wallets → most new users default to custodial.

Bank heuristics: auto-flags on coinjoin/Lightning ramps; delays; Enhanced Due Diligence (EDD) → “ETF easy, self-custody hard”.

Pool policy clients: insurer/utility guidance → template convergence; steerable settlement without declarations.

Tax/reporting defaults: self-custody = paperwork/audits, custody = simple → behavior at scale.

Cloud/CDN throttles: ToS/rate-limits on wallet servers/RPC → degraded sovereign UX.

Content liability blending: “node = distributor” narratives chill public nodes.

Each is policy-cheap and mass-effective; court challenges are slow.

Concrete examples of the Tax

Spam-vector economics: cheap witness/OP_RETURN bloat; defenders must craft nuanced policy; attackers call it “market choice”.

Template monoculture: big pools converge on similar policy clients; transaction selection becomes policy-sensitive.

App-store soft bans: non-KYC wallet updates lag/fail; user migration to custodial by default.

Bank heuristics: “coinjoin = Enhanced Due Diligence” — users abandon coin control.

Where this equilibrates

Price corridor: cyclically positive, blow-offs capped, floors defended when convenient.

Usage: Store-of-Value inside custody; Medium-of-Exchange in niches; sovereignty survives as a minority practice.

Settlement: increasingly steerable (pool templates + AML analytics + KYC routing).

Narrative cadence: “Regulatory clarity” pumps → new controls ratchet → paper share rises → realized volatility grinds down → repeat.

How to Measure the Drift (KPIs)

Paperization ratio: (ETF + futures + structured notes + public treasuries) / float.

Custody share: % at reporting custodians vs sovereign addresses (heuristic).

Pool template diversity: entropy across templates; share running policy clients; non-custodial payout adoption.

App-store distribution: search rank/update latency for non-KYC wallets.

Legal friction index: active node/wallet threats + tax-form complexity.

Mempool health: median/95th mempool size, UTXO growth vs active users.

If 3+ trend the wrong way for 2–3 quarters, expect higher paper share, lower realized vol, and stagnant Medium-of-Exchange.

If someone wanted to Fight (minimum viable defense)

Policy-hardening clients: spam-costing, non-censorable mempool standards; change-explanation one-pagers; fast rollback tooling.

Pool resilience: DATUM/Stratum v2 + non-custodial payouts; insurance alternatives tolerant of policy-neutral templates.

Wallet distribution: “Simple sovereign” defaults; compliant wrappers; alt-stores/sideloading.

Legal insulation: model legislation for infrastructure immunity; long-horizon counsel funding.

Funding depoliticization: multi-sig, multi-jurisdiction grants; cap single-donor sway.

Metrics transparency: quarterly capture dashboard; argue with numbers, not ideology.

Absent this, drift isn’t a bug — it’s equilibrium.

Use this Lens

Incentives > ideals: users buy convenience; businesses buy liability shields; politicians buy cheap control.

Control > fairness: defaults beat debates; an Acceptable Use Policy beats a manifesto.

Stability > truth: systems accept narrative inconsistency when it lowers enforcement cost.

Protocol math can’t overcome perimeter defaults.

What would change my mind: defaults protecting sovereignty (wallets, app stores, tax, pools) + enterprise on-chain settlement.

The most common Bitcoin misconceptions (misconception → reality map)

I have to finish this article with the most common Bitcoin misconceptions.

The kind of stuff Bitcoiners repeat on autopilot without having done much research.

Most of these are protocol-level truths that fail in the real world.

Supply, issuance, and “21 million”

1) “There can only be 21M coins.”

Reality: Protocol caps base units at 21M BTC. Markets can (and already do) create synthetic claims (ETFs, futures, swaps, rehypothecated custodian balances) that exceed 21M. Price discovery then reflects claims supply, not just on-chain supply.

Implication: Paper-share ↑ ⇒ realized vol ↓; upside rallies capped; custody proof matters.

2) “Halvings guarantee higher prices.”

Reality: Halvings cut flow, not stock; the market prices it years ahead. Price path is liquidity + policy perimeter more than calendar folklore.

Implication: Trade liquidity regime (net-liquidity, issuance mix) over date-based rituals.

3) “Stock-to-flow proves long-term targets.”

Reality: S2F ignores synthetic supply, demand substitution (stables), and policy gating. Narrative comfort, not a pricing model.

Security, hashrate, and mining power

4) “Hashrate up = security up, full stop.”

Reality: Pool control and policy clients determine censorship risk. Top pools ≈ majority of hashrate; pools, not individual miners, decide templates in most cases. DATUM/Stratum V2 are not ubiquitously enforced.

Implication: Watch pool policies, OFAC filtering, template standardization — not just hashrate charts.

5) “Miners can’t censor; the network routes around it.”

Reality: With a few pools coordinating templates/filters, effective censorship windows are feasible (delay/confiscate fees, exclude sets). Economic pressure (insurers, exchanges) makes templates converge.

Implication: Throughput is less of a limit than who writes the block template.

6) “51% attacks are unrealistic.”

Reality: A sustained double-spend is unlikely; policy-driven soft censorship via pools is very realistic and cheaper.

Implication: The live risk is transaction selection bias, not sensational double-spends.

Decentralization, nodes, and governance

7) “Running a node makes you sovereign.”

Reality: True only if you broadcast/receive freely and your node isn’t policy-exposed (cloud TOS, ISP rules, “illegal content” liabilities).

Implication: Home-hosted + Tor/Meshtastic + storage hygiene > cloud VMs.

8) “The client ecosystem is diverse.”

Reality: Bitcoin Core dominates; alternative clients (Knots) are minority. Mempool policy (not consensus) shapes usable transactions; a few maintainers wield outsized agenda-setting power.

Implication: Track policy pull requests, default knobs, and release cadence; “ossified” is a story, not a guarantee.

9) “Protocol is immutable. It’s like TCP/IP.”

Reality: Consensus changes are rare, but policy-level changes (relay/size/standardness) shape what’s practically allowed.

Implication: “Immutability theater” can coexist with effective governance via defaults.

10) “User-activated soft forks prove ultimate user power.”

Reality: UASF worked in that instance with massive social coordination + aligned miners/exchanges. Don’t generalize; future coordination may face legal/app-store/bank choke points. Past upgrade processes (e.g., BIP9, BIP8, “Speedy Trial”) revealed that miners and coordinated developers can accelerate or block changes faster than ordinary users can veto. Power concentrates among aligned institutional actors.

Censorship resistance & privacy

11) “Bitcoin is anonymous.”

Reality: It’s highly linkable without disciplined hygiene; chain analytics + KYC perimeters deanonymize most flows.

Implication: Treat KYC coins as identity-linked UTXOs; privacy = behavior + tooling + opsec.

12) “It can’t be censored.”

Reality: The perimeter censors (banks, app stores, exchanges, cloud), not necessarily the base layer. That’s enough to throttle adoption.

Implication: Watch wallet distribution policies, travel-rule hubs, blacklists.

13) “Fungibility is perfect.”

Reality: Taint analysis already segments coins; some venues price/ban “dirty” UTXOs.

Implication: Expect two-tier markets; privacy coins/coinjoins face higher policy risk.

Payments, scaling, and usage

14) “Bitcoin is ready for mass payments.”

Reality: Base layer is final settlement. L2s (Lightning) help, but custodial hubs dominate real usage; when fees spike, UX breaks.

Implication: Payments narrative ≠ revealed usage; stables on KYC rails win MoE for now.

15) “Lightning is decentralized enough.”

Reality: Liquidity centralizes in large hubs; channel management is arcane; mobile UX defaults to custody.

Implication: Treat Lightning as semi-custodial router unless you run channels seriously.

16) “Fees = healthy demand.”

Reality: Fees can reflect adversarial or non-monetary demand (inscriptions/spam). High fees can crowd out Medium-of-Exchange and force custody usage.

17) “Finality is instant after 1 confirmation.”

Reality: Economic finality is contextual (value, counterparty risk, mempool state); L2/hosted wallets reintroduce reversibility and policy gates.

Regulation, custody, and paperization

18) “ETFs ‘legitimize’ Bitcoin.”

Reality: They paperize exposure, centralize voting/custody, and let Wall Street set the tape via derivatives basis and inventory.

Implication: Vol suppression ↑; adoption ↑ (in accounts); self-custody share ↓.

19) “KYC isn’t a big deal.”

Reality: KYC binds identity to UTXOs forever; perfect for retroactive enforcement (tax, sanctions).

Implication: Expect forensic tax & AML dragnets when politically expedient.

20) “Proof-of-reserves is coming for everyone.”

Reality: Most large custodians dodge robust PoR; incentives prefer opacity (rehypothecation flexibility, headline risk avoidance).

Implication: Demand deterministic PoR + liabilities or treat balances as IOUs.

21) “Self-custody is safe by default.”

Reality: Key management and inheritance are non-trivial; many “self-custody” wallets are policy-exposed (push updates, app-store bans, proprietary firmware).

Implication: Multi-sig + geographically / vendor-diverse storage or accept counterparty risk.

22) “Bitcoin can’t be banned.”

Reality: True at protocol level; functionally it can be taxed, surveilled, rate-limited, and reputationally tainted so most people won’t use it.

Implication: Expect Store-of-Value containment, not outright bans, in developed markets.

Markets, liquidity, and price action

23) “Price = pure adoption signal.”

Reality: Price = macro liquidity + paper positioning + policy perimeter. Weekends/holidays show liquidity hunts (stop cascades).

Implication: Track net liquidity, basis, ETF flows, funding, dealer gamma.

24) “Open interest up = bullish.”

Reality: OI can be short carry or market-making; without context (basis, funding) it’s meaningless.

25) “Volatility will stay the same forever.”

Reality: As paper share (ETFs, futures) and custody concentration rise, realized vol tends to compress; blow-offs get capped; crashes remain narrative-timed.

26) “Decoupling is imminent.”

Reality: BTC rides USD liquidity cycles and global risk. True decoupling requires payments-level adoption or policy shock — not vibes.

Tech narratives and “future risks”

27) “Quantum will kill Bitcoin soon.”

Reality: Near-term PQC timelines make apocalypse unlikely. The use of quantum FUD performs policy steering (“use our ‘quantum-safe’ rails”).

Implication: Treat quantum panics as buy-the-scare / fade-the-headlines, but avoid complacency on migration paths.

28) “Energy FUD is the existential risk.”

Reality: Energy is a political lever more than a physics limit; miners chase stranded/curtailed power. Real risk is jurisdictional capture of pools/sites.

Implication: Track where hashrate sits and what policy clients pools run.

29) “Core devs are neutral referees.”

Reality: Funding sources & platform perimeters (GitHub, app stores) are levers. Policy-level changes (standardness, relay) matter.

Implication: Follow maintainer debates, policy pull requests, and sponsor footprints, not just conference slides.

30) “Inscriptions/OP_RETURN size changes are harmless.”

Reality: UTXO set bloat + legal exposure (illegal payload risk) + forced policy responses can degrade decentralization or provide pretext for gating.

Implication: Expect node-operator chilling effects and more custody reliance if worst-case content appears.

Adoption & human behavior

31) “If it’s better tech, people will adopt it.”

Reality: Convenience beats truth. Stables with KYC + superior UX win Medium-of-Exchange until incentives flip.

Implication: Bitcoin Store-of-Value containment is the base case; Medium-of-Exchange adoption requires mass incentives or policy failure.

32) “Education will fix it.”

Reality: Behavior follows defaults and rebates, not whitepapers. Policy can make stables default, apps can hide Bitcoin; outcomes follow.

33) “Institutional adoption = censorship resistance success.”

Reality: Institutionalization usually means perimeter compliance, paperization, and template steering.

Bitcoin: from monetary revolution to trade/hedge

Medium-of-Exchange (MoE): Every step that makes retail MoE smoother (Lightning hosted nodes, LN custodians, KYC bridges) recentralizes custody or metadata. Self-custodial MoE remains niche: higher cognitive load, merchant tax friction, and social-graph visibility risks.

Store-of-Value (SoV): The path of least resistance is paper SoV (ETFs, custodians) and KYC SoV (CEX + travel rule) because advisors, pensions, treasurers can buy it. That caps upside convexity (basis/carry arbs absorb squeezes) and keeps policy leashes attached.

Best realistic role: Shock convexity hedge against “Great Taking / capital controls” if and only if you hold self-custody, privacy-hardened, minimizable-footprint coins. The hedge is asymmetric to perimeter failure, not to ETF flows.

Low Gross Consent Product era makes co-option the default

Governments avoid long austerity; they prefer programmable rails (stablecoins → CBDCs) and admissible AI.

Containment equilibrium: Allow investable Store-of-Value wrappers (ETFs) to placate demand, discourage Medium-of-Exchange and sovereign habits. Manage volatility, tax frictions, and reputational risk. That’s stable containment.

Bottom line

When states can choose (cheaply) between letting Bitcoin become mass Medium-of-Exchange vs containing it, they contain. When users can choose between sovereignty vs defaults, they default.

Protocol truth without perimeter control is a philosophical win and a market loss.

The coordination tax prices the delta between those.

In a world of defaults and choke points, sovereignty becomes a minority practice and a tail option.