Central Banks are likely preparing for a financial reset

The architecture is there. The question is when and how hard they decide to use it.

I think it’s very likely that Central Banks are preparing for a financial reset.

As always, I could be wrong, so take everything with a grain of salt.

The question is:

If the Controllers were prepping a Freegold + Great Taking reset while simultaneously locking in an AI-governance regime (not just surfing an AI bubble as advertised by mainstream media), what would the reveals look like, and how close is reality to that pattern?

I am not familiar with this lady, but she’s got some great points. She summarizes the World Economic Forum financial reset talking points.

Treat this as a thought experiment. I don’t have any insider information.

1. What should we see if my combo-model is roughly right?

Under my assumptions, the Controllers need to do three big things in parallel:

Monetary / collateral stack:

Prepare for Freegold: consolidate physical gold at CB/sovereign level, keep retail in paper claims, preserve optionality to revalue later.

Prepare for Great Taking: make sure legal & custody rails allow them to sweep collateral and haircut claims in a systemic event.

Digital / legal rails:

Build CBDC + tokenized collateral + digital ID rails that can run post-reset.

Make sure custody is dematerialized, intermediated, and legally structured as claims on a pool, not direct title.

AI governance regime, not just an AI bubble:

Use the AI boom narrative to justify building AI governance infrastructure:

model registration / eval,

provenance/watermarking,

compute tracking,

alignment/safety bureaucracies,

integration with KYC/AML/critical infrastructure.

End-state: AI as the governance OS sitting on top of:

CBDC rails,

digital ID,

surveillance/compliance stacks,

gold-marked central bank balance sheets.

So the “signs” bucket down into:

Gold / reserves behavior

Legal–custody architecture

CBDC / ID / programmable-money buildout

AI governance (not just AI hype)

Physical Gold, BTC & other leaks treated as contained corridors

Timing pattern that fits the Debt/Liquidity + midterm year discipline window

2. Freegold pre-positioning: what we’d expect vs what we see

If Freegold was part of the plan, you’d expect:

Persistent, non-trivial central bank gold accumulation, especially by EM/BRICS.

Accounting setups that make gold revaluation plug-and-play

(mark-to-market gold reserves, not fixed parity, not pretending gold is irrelevant).No official promise to “back” currency with gold (too constraining), but a steady drift toward:

more gold in reserves,

more talk about “diversification” and “resilience”.

Retail narrative: gold is boring, barbarous relic, “boomer rock”, while behavior quietly contradicts that.

Legal + Basel regime that slowly upgrades fully allocated physical gold as “nice collateral”, but treats unallocated/paper as second-class.

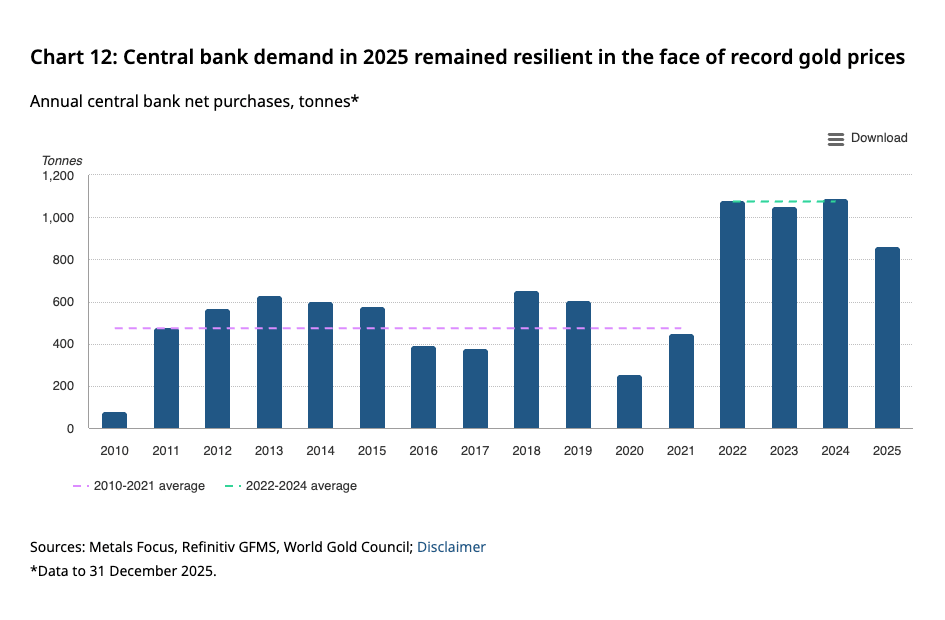

Reality check (without pretending this proves anything):

Central Banks have indeed been massive net buyers of gold in the last few years, with EM/BRICS doing a lot of the work.

That’s exactly the opposite of “we don’t care about gold”. It’s consistent with: “we want this asset on our balance sheet, not yours”.

The Eurosystem really does mark gold to market. That’s structurally Freegold-ish: no peg, but gold as a marked reserve plug.

The public narrative (“gold is just one of many reserves / diversification”) is tame; the revealed preference (record tonnages bought into official vaults) is not tame.

Retail gets funneled heavily into paper gold (ETFs, unallocated accounts) rather than pushed toward taking bars home.

Banks and custodians are visibly happier when you hold claims, not metal.

Alignment with the Freegold lens:

High in pre-positioning phase. We do not see open coordination on a gold reset (they wouldn’t telegraph it), but the combo:

CB buying pattern,

Euro gold accounting,

Basel’s relative friendliness to allocated gold,

is almost exactly what the Freegold story would want to see before a crisis-triggered revaluation.

If my model is totally wrong, the behavior is… still interesting.

3. Great Taking plumbing: how much of the architecture is in place?

If Great Taking is the plan, then structurally you want:

Dematerialization of securities

Everything in street name, no bearer certs, no simple “I have the certificate, I own the thing”.

Central Securities Depositories & omnibus pools

DTCC / Euroclear / Clearstream / CSDs holding the true title; retail and funds hold entitlements.

Legal language shift from “you own X” → “you have a securities entitlement against participant Y, which has a claim on the pooled asset”.

Rehypothecation & omnibus custody standard, not exception.

Post-GFC resolution & bail-in regimes that:

give Central Counterparty Clearing Houses (CCPs) and systemic entities superpriority over beneficial owners,

allow conversion/haircuts on claims inside resolution,

explicitly allow bail-in of creditors and sometimes large depositors.

ETF-ization of everything

Highly intermediated, pooled, rehypothecable structures for almost every asset class.

Cross-border harmonization of these rules via FSB/BIS/EU directives, etc.

Reality:

Dematerialization is near-total in developed markets. Retail almost never has direct registered ownership; they hold “entitlements” via brokers.

Centralized Central Securities Depositories (CSDs) and omnibus custody are the default, not a niche.

Legal terms like “securities entitlement” vs “direct ownership” are not conspiracy fodder; they’re just there in the documents.

Post-2008 we really did get a wave of bail-in / resolution frameworks, especially in EU/UK, that explicitly prioritize systemic stability and allow wiping/convertings of certain creditor layers.

ETFs have become universal wrappers: equity, bonds, gold, vol, credit, factors, whatever. Most are held via brokers/custodians into the same omnibus pools.

Many brokerages explicitly reserve rights in margin agreements and rehypothecation clauses that make “your” asset part of a complex collateral pool.

Alignment with “Great Taking as design, not accident”:

Structurally very high. You don’t need to believe that “they will definitely press the red button” to see that:

The architecture is set up so that if a systemic crisis (artificial or not) hits and policy chooses “save system / haircut claimants”,

the path of least resistance is exactly what the Great Taking story describes:

CCPs and Central Banks get the assets/collateral;

end users get haircutted claims, IOUs, or “units” in resolution vehicles.

The underlying assets survive in the official perimeter; what gets killed is the claim stack. The pipes are absolutely compatible with that. Whether they will use them that way is the open variable, not the feasibility.

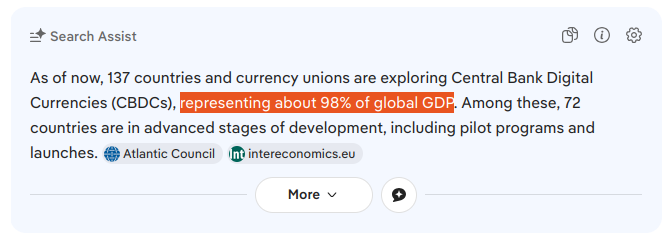

4. CBDC / programmable money / ID rails: signs of perimeter sealing

If the plan is Great Taking → Freegold → CBDC regime, you’d expect:

CBDC experiments everywhere, especially wholesale and retail pilots.

Parallel work on:

national digital IDs,

eIDAS-style frameworks,

biometric/ID wallets,

KYC/AML harmonization across banks, fintechs, and platforms.

Tokenization / Distributed Ledger Technology experiments for securities and collateral:

tokenized Treasuries, MMFs, repo, etc.

not because they love crypto, but because they want programmable, trackable collateral.

Treat tokenization as: turning everything important into machine-readable, permissioned, and programmable state.

Travel rule & chain surveillance for Bitcoin on/off-ramps to keep leaks manageable.

Narrative cover: “inclusion”, “efficiency”, “innovation”, “privacy-by-design” (with plenty of room for “design changes” later).

Reality:

Pretty much every major Central Bank has a CBDC project: some in pilot, some in advanced research.

Digital ID frameworks (EU eIDAS 2.0, national e-ID, etc.) are not theoretical; they’re being legislated/rolled out.

“Tokenization of real-world assets” is now a mainstream buzzword in tradfi: Treasuries, money funds, repo, etc., being put on permissioned ledgers.

Bitcoin regulations trend toward:

licensing of intermediaries,

travel-rule implementation,

chain surveillance partnerships,

containment rather than full elimination.

You can already see the blueprint:

ID + KYC + tokenized-deposit/stablecoin/CBDC + realtime data for supervisors.

Alignment with my lens:

Strong. Even if you forget Great Taking / Freegold, the perimeter-sealing, programmable-money architecture absolutely matches a “lock in the population” design.

Layer that under a Freegold reset, and CBDC just becomes:

The domestic Medium-of-Exchange/Unit-of-account inside your block,

with gold as the inter-bloc settlement & reserve anchor,

and self-custody BTC, Monero / gold as small tolerated leaks.

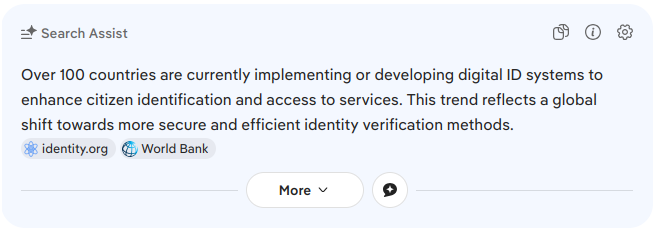

5. AI governance regime vs AI bubble: which one are we seeing?

The mainstream media sees “AI bubble”; the Controllers are really building an AI governance regime that will be the decision OS for the new rails.

If AI governance is the true project, we’d see:

Rapid buildout of AI regulatory scaffolding, faster than is “normal” for new tech:

AI acts, executive orders, safety institutes, guidelines.

Risk-tiering and registration of models and uses:

“high-risk”, “critical infrastructure”, “general purpose” categories.

Mandatory evals, logging, provenance, especially for:

models over certain parameter/compute thresholds,

critical decision use-cases (finance, health, policing, infra).

Watermarking / C2PA / content authenticity standards:

cryptographic signatures on content,

linking into identity and platform-level enforcement.

Integration of AI rules with existing KYC/AML/cyber/critical-infrastructure law.

At the same time, financialization and hype around AI equities, to:

fund the buildout,

launder the rails into “market success”,

distract from the governance lock-in.

Reality:

AI is being regulated much faster than the internet ever was early on.

Multiple jurisdictions are racing to define:which models must register/report,

what constitutes “high risk”,

what logging / governance is required.

“AI safety” institutes, eval regimes, watermarking, provenance:

These are being built in parallel with the commercial boom, not 10 years later.

That’s not typical laissez-faire capitalism; that’s a sign that states see AI as critical infra from day 0.

Public narrative is “AI bubble”, “Nvidia mania”, “AGI hype”.

But the rail-level story is:AI becomes embedded in critical processes (military, intel, tax, AML, procurement, infrastructure ops).

Those deployments are sticky and live behind classification, NDAs, and sovereign clouds.

So bubble vs regime?

Yes, there is a bubble element (valuation, retail mania, momentum).

And yes, the governance regime is being built underneath:

supervised, ID-tied access to powerful models,

compute control,

safety bureaucracy,

content provenance tied to identity.

That’s exactly what “AI governance regime piggybacking on AI bubble” should look like:

Bubble = consent pump + funding + plausible deniability.

Governance regime = lasting skeleton integrated with ID, CBDC, ISR, and risk-management rails.

This is what the buildout of AI governance looks like.

6. BTC, gold, and other leaks: containment vs kill

Under my assumptions:

BTC & self-custody gold are leaks in the system, not primary rails.

The Controllers want to contain, not kill them:

too useful as volatility sinks and tail hedges,

too many adversarial constraints to outright ban,

outright war on them would burn legitimacy and push flows offshore.

What we’d expect:

Paperization and institutional wrappers:

ETFs, notes, futures, structured products that bring most BTC exposure inside custodial, surveilled channels.

Medium-of-Exchange friction:

tax, AML, KYC, travel rule on uses as money.

difficulty of using BTC for everyday settlement without touching surveilled rails.

Simultaneous on-chain tolerance + off-chain pressure:

self-custody technically allowed,

but on/off ramps, wallets, and services increasingly regulated or choked.

Gold:

similar split: physical self-custody tolerated but inconvenienced (KYC, reporting, taxes),

paper gold fully inside collateral/custody system, Great-Taking-compatible.

Reality:

BTC is being aggressively paperized via ETFs/futures/notes, while:

KYC/AML rules for crypto intermediaries intensify,

chain surveillance is normalized,

Medium-of-Exchange usage is limited by friction & regulatory uncertainty.

We see no serious attempt to fully kill BTC in major blocs, but plenty of:

scapegoating,

regulation,

behind-the-scenes de-banking of some intermediaries.

Gold:

Physical bars/coins remain legal but are made:

more KYC’d,

tax-complicated in some jurisdictions,

socially framed as “paranoid” or “boomerish”.

Paper gold is the dominant exposure form for most investors.

Alignment:

Perfect with the “contained leaks” story: they prefer BTC/gold to exist as corridors and volatility sinks, not as central pillars. The infrastructure choices reflect that.

7. AI governance + Freegold + Great Taking: do the layers actually talk to each other yet?

If my full combo is directionally right, eventually I’d expect to see explicit or implicit coupling between:

Risk/Resolution rails (Great Taking plumbing),

Monetary reset options (gold, FX, CBDCs),

Governance/AI rails (who watches, who simulates, who decides).

What that would look like:

AI/analytics vendors (Palantir-type, gov cloud vendors) increasingly embedded in:

supervisory stress-testing,

systemic risk modeling,

resolution planning,

war gaming around liquidity & collateral crises.

AI governance frameworks that explicitly tie into:

financial stability mandates,

AML/KYC,

critical-infrastructure classification.

CBDC / digital ID pilots that:

integrate AI-based risk scoring, anomaly detection, behavioral models,

plug straight into tax, benefits, and compliance systems.

“Resilience” rhetoric:

AI + digital finance described as making the system more resilient to crises, cyberattacks, and “disinformation”.

Reality (from public reveals):

Vendors like Palantir / hyperscalers / gov-cloud players are very explicitly embedded in:

defense, ISR, crisis logistics,

financial crime, AML, tax,

critical infra planning and monitoring.

That’s governance OS creep.

AI is appearing in supervisory stress-testing and compliance tooling: “AI for fraud detection”, “AI for risk”, etc.

That’s the proto-governance regime integrating with financial rails.CBDC and digital ID docs are full of AI-inflected language about:

risk scoring,

fraud/anomaly detection,

smart, targeted policy interventions.

We’re early, but the direction is clear: AI + ID + money + risk are being welded together, not kept separate.

8. Timing: are we in the pre-snap, Midterm year discipline window?

Big Debt/Liquidity under-injection + refi walls + US Midterm year discipline window = prime moment to:

allow an “accident”,

then run Hegelian loop: Problem → Reaction → Solution (reset + rails).

Right now (Feb 2026):

US is moving into Year 2 of the presidential cycle (2025–2028 term).

They usually under-inject liquidity in midterm years as a default. This is not a hard rule. There are too many variables.

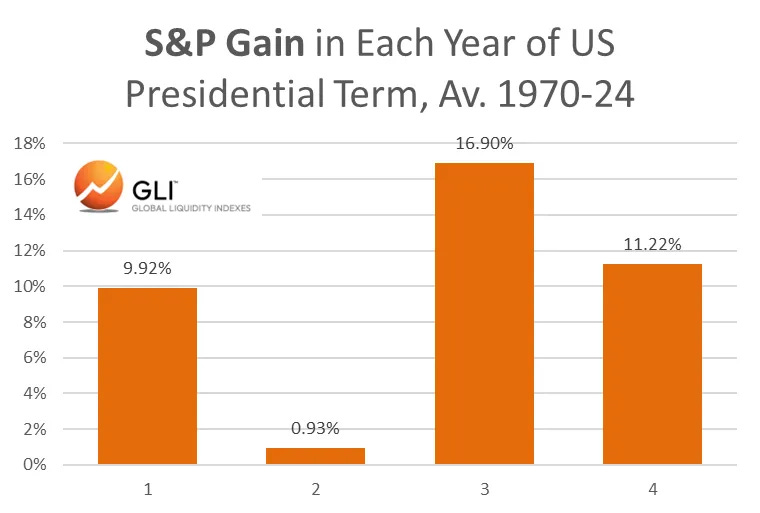

This chart I stole from Michael Howell illustrates this:

Structural debt levels, deficits, and refi walls are not improving; they’re worse.

That alone means something will have to give in the next 4–8 years:inflation,

funding crisis,

stealth financial repression,

some form of reset.

My read:

We look very much like we’re in the pre-snap / early-down regime:

rails (AI, CBDC, ID, custody architecture) are being put in place,

legal frameworks for bail-ins/resolution are mature,

Central Bank gold accumulation has already happened in size,

AI governance infrastructure is moving from PDF → institution.

What we don’t see yet:

No explicit “this is the new gold-anchored monetary system”.

No open, coordinated push to advertise gold as the anchor. That would only appear after a crisis narrative.

You only show the “Solution” after the “Problem + Reaction” phase.

9. Quick scoreboard

If Freegold + Great Taking + AI governance were real prep, I’d expect these signs:

A. Central Bank gold accumulation & mark-to-market (MTM) accounting

Expected: steady official gold buying, MTM accounting (Eurosystem-style).

Seen: ✅ Strongly present.

Fit: High.

B. Dematerialized, pooled custody with bail-in resolution powers

Expected: omnibus custody, “securities entitlements”, global bail-in/CCP resolution frameworks.

Seen: ✅ Strongly present.

Fit: Very high.

C. ETF-ization / rehypothecated paper layers over real collateral

Expected: everything in ETFs/pooled structures, gold included.

Seen: ✅ Strongly present.

Fit: High.

D. CBDC / digital ID / tokenized collateral buildout

Expected: pilots, legislative frameworks, KYC harmonization.

Seen: ✅ Strongly present.

Fit: High.

E. AI regime buildout (evals, safety institutes, provenance, export controls) alongside the AI equity mania

Expected: yes.

Seen: ✅ Present, and unusually early vs normal tech cycles.

Fit: High for “governance regime piggybacking on bubble”.

F. Explicit coordination of gold with AI/digital rails in public narrative

Expected: Not yet if they’re still in pre-snap; you’d see this after the crisis.

Seen: ❌ Not present in any overt way.

Fit: Absence is actually consistent with “we’re not in the post-reset PR phase yet”.

G. Large-scale, explicit seizures/haircuts of securities entitlements in a systemic event (actual Great Taking switch-flip)

Expected: only at/after a major crisis.

Seen: ⚪ Not yet at global scale (we’ve seen mini-bail-ins, but not a full sweep).

Fit: Pending. This is the big “if they’re going to do it, they haven’t yet”.

H. Open admission that gold is being re-centered as reserve anchor

Expected: only after the revaluation or as part of the “new architecture” pitch.

Seen: ⚪ Not really; just “diversification”.

Fit: Also pending.

10. Where I land

The rails and plumbing look very compatible with the scenario I’ve described.

Central Bank gold behavior & euro accounting = Freegold-compatible.

Custody & resolution = Great Taking-compatible.

CBDC/ID/tokenization = perfect perimeter + re-denomination rails.

AI governance ramp = exactly what a regime OS buildout looks like, not just a random bubble.

What we haven’t seen is the actual “snap”:

No broad collateral sweep and mass haircut of beneficial owners yet.

No open gold re-anchoring.

So the honest meta:

We are definitely seeing the preconditions and infrastructure if my model were roughly right.

We are not yet seeing the overt, irreversible moves (full-scale Great Taking event + explicit Freegold reset).

Whether this is:

(a) deliberate staging for that combo,

(b) emergent bureaucracy + covering-the-bases + path dependence that could be used that way in a crisis,

(c) or a full coincidence that happens to look like this script,

is ultimately an inference problem, not a provable fact.

All in all:

The Controllers have absolutely given themselves the option to run a Great Taking → Freegold-ish reset, with AI as the governance OS and CBDC/ID rails underneath.

We’re still in the option-writing phase, not the option-exercising phase.

I’d treat it as:

Non-trivial probability that the option gets exercised during a major Debt/Liquidity accident in the next big cycle,

Positioning probably looks something like:

physical gold + self-custody BTC, Monero as expropriation convexity,

minimal exposure to long-duration paper claims that live entirely inside Great-Taking-friendly custody stacks.

The architecture is there. The question is when and how hard they decide to use it.

As always, I could be wrong on some/all of this.

More context: