The BIS wants to steal our assets; All G20 countries agree

The Financial Stability Board document is the global legal blueprint that makes the “Great Taking via resolution/bail-in” mechanically possible, cross-border, and fast.

I already explained why I think Central Banks are preparing for a financial reset.

The Bank for International Settlements (BIS) won’t stop publishing documents that instruct every G20 country how to legally steal our assets in a “crisis” without using the word “expropriation”.

The global “resolution” constitution is their “Key Attributes of Effective Resolution Regimes for Financial Institutions” framework.

No one reads these documents other than the people who are going to be stealing our assets, so I’ll translate their Basel technocrat into plain English.

That FSB (Financial Stability Board) document is the global legal blueprint that makes the “Great Taking via resolution/bail-in” mechanically possible, cross-border, and fast.

This document makes a fast collateral sweep feasible over a weekend, not over years.

1. What this document actually is

Who:

This FSB is the Financial Stability Board, the BIS/G20 coordination node in Basel, not the Russian security service.

What:

The Key Attributes (KAs) are basically the global resolution constitution:

They tell every G20 / systemically relevant country:

“Your bank/insurer/broker/Central Counterparty Clearing House (CCP) resolution laws must look like this if you want to be considered ‘compliant’ and plugged into the club.”Then national laws (EU BRRD/SRMR, UK Banking Act, US OLA/SPOE, etc.) are written to conform to these attributes.

In other words:

BIS/FSB = one of the top-layer meta-law coders for the financial system.

This document = template for who can be legally rugged, how, in a crisis, without using the word ‘expropriation’.

It’s not about “good governance”. It’s about:

“When the belt stalls on the Debt/Liquidity conveyor, here is the authorized way to seize, haircut, and convert claims while preserving the core collateral stack and the critical rails.”

That’s exactly the Great Taking script, but written in Basel technocrat.

2. High-level structure

The Key Attributes (KAs) are organized into a dozen or so “attributes”, plus annexes. Conceptually they cover:

Scope:

Which entities can be put into special resolution instead of normal insolvency.Authorities & triggers:

Who can push the button, and when, without waiting for courts.Resolution powers:

What tools they get: bail-in, transfer, bridge bank, asset split, stays on contracts.Safeguards & creditor hierarchy:

“No creditor worse off than in liquidation” and other PR constraints.Bail-in mechanics & Total Loss-Absorbing Capacity (TLAC)/Minimum Requirement for Own Funds and Eligible Liabilities (MREL):

The forced write-down/convertibility of liabilities and the requirement to pre-issue “loss-absorbing” debt.Funding in resolution:

Resolution funds, backstop credit lines, how to keep the thing breathing while you carve it.Client assets & Financial Market Infrastructures (FMIs):

How to treat custody, client money, Central Securities Depositories (CSDs), Central Counterparty Clearing Houses (CCPs), etc.Cross-border recognition:

Making sure foreign courts / hosts respect the home authority’s bail-in / transfer.Planning, data, valuations:

Living wills, resolvability assessments, Margin Intraday Square Off (MIS), how to do provisional valuations.Sector-specific annexes:

Banks, insurers, Financial Market Infrastructures (FMIs)/Central Counterparty Clearing Houses (CCPs).

From a Great Taking lens, the lethal parts are:

Broad scope (banks + non-banks + holding companies + Financial Market Infrastructures)

Bail-in powers over unsecured liabilities

Treatment of “securities entitlements” and client assets

Cross-border recognition of bail-ins and stays

Priority protection of CCPs/CSDs and key FMIs (the collateral nexus)

Let’s translate the core bits into plain English.

3. Scope: who can be resolved (and thus “taken”)

The Key Attributes (KAs) say: your regime must cover any financial institution whose failure could be systemic.

Concretely this extends resolution powers to:

Banks (obviously)

Significant broker-dealers and investment firms

Insurers (via annex)

Holding companies of financial groups

Financial Market Infrastructures (Central Counterparty Clearing Houses, Central Securities Depositories, payment systems), at least via annex guidance

Systemically important non-bank financial institutions, if designated

Translated:

Don’t just be able to rug a single mid-tier bank. Make sure all the nodes that actually sit on the collateral stack–including Central Counterparty Clearing Houses and custody nodes – can be put into special resolution.

Because the Great Taking needs more than just banks:

You need to be able to seize control of pools held at Central Counterparty Clearing Houses/Central Securities Depositories/custodians without getting stuck in a million domestic insolvency courts.

4. Resolution authorities & triggers: who pushes the button

Key themes:

Each jurisdiction must have one or more administrative resolution authorities with:

Operational independence,

The power to act without shareholder/creditor consent,

The ability to move faster than a court process.

Triggers: “non-viable or likely to be non-viable” – deliberately fuzzy:

It’s enough that the authority judges the firm won’t survive and that normal insolvency would be “disorderly”.

Translated:

This is the shift from court-supervised bankruptcy (slow, many veto points) to administrative decapitation:

The resolution authority can step in before real insolvency,

declare the institution “failing or likely to fail”,

and activate the toolkit.

For the Great Taking:

You don’t wait until everything is obviously dead and collateral chains are snapped.

You preemptively seize and restructure key firms in a controlled fashion when the Debt/Liquidity under-injection + accident scenario hits.

5. Core resolution powers: the actual toolkit

The Key Attributes (KAs) list a bunch of powers every regime should have. Translated:

5.1 Transfer powers

Move assets, liabilities, and critical functions to:

another private-sector acquirer,

a “bridge institution” (temporary bank),

or an asset management company / bad bank.

Effect:

You can split the carcass:

“good” assets + core services → bridge bank/new entity (protected),

“toxic” assets and “expendable” liabilities → bad bank or left in the old shell.

Use transfer powers to move good collateral and payment rails into protected structures, while leaving risk-bearing investors/creditors in the old shell to be wiped or bailed-in.

5.2 Bail-in powers

Authority can write down equity and certain unsecured liabilities, and/or convert them into equity in the bridge / new entity.

This is the standardized “bail-in” concept: losses are imposed on shareholders and specified creditors instead of taxpayer bailouts.

Mechanically:

Old equity → zero or near zero.

Subordinated / senior unsecured debt → written down or converted into new equity.

Potentially: some large uninsured deposits / wholesale funding instruments in the stack.

In Great Taking:

Bail-in is the legal loss-allocation gun pointed at all non-protected claims: it’s how you can zero or haircut a huge swath of household/institutional paper (bonds, certain deposits, structured notes) in one weekend, while keeping the core assets and operations intact.

5.3 Stays on early termination rights

Resolution authority can impose temporary stays on:

early termination,

close-out netting,

collateral enforcement,

for qualified financial contracts (derivatives, repos, etc.).

Official story: “Avoid a fire-sale spiral; give us time to transfer or restructure.”

Translated:

This is the “freeze” phase: contracts that would let counterparties grab collateral and rip it out of the system are paused.

The authority can then re-pipe those contracts and collateral into new entities, decide who eats the loss, and only then let the game resume.

5.4 Asset separation

Ability to move impaired assets (toxic loans, junk securities) into an asset management vehicle (“bad bank”).

Good pool (payments, core lending, good collateral) gets protected and recapitalized.

Again: collateral and core functions are preserved; claims on toxic stuff are isolated.

6. Creditor hierarchy, TLAC, and who gets hit

The Key Attributes (KAs) insist on:

6.1 Loss hierarchy

Respect normal insolvency hierarchy: equity first, then subordinated debt, then senior unsecured, etc.

Introduce “no creditor worse off than in liquidation” (NCWO) safeguard:

After the dust settles, if a creditor would’ve recovered more under normal insolvency than under resolution, they can claim compensation (from a resolution fund).

Reality:

This is a backstop narrative + litigation risk control:

Resolutions rely on provisional valuations in chaos,

NCWO assessments are done years later by consultants.

As long as you can argue a plausible liquidation value, you can say: “No one is worse off”.

Great Taking lens:

This gives you the legal cover to impose very deep haircuts in the moment, as long as you can retro-justify that under some liquidation scenario. It’s a post-hoc fairness audit, not a real brake.

6.2 Total Loss-Absorbing Capacity / Minimum Requirement for Own Funds and Eligible Liabilities

Later FSB guidance (and EU’s BRRD) build on Key Attributes to demand:

Total Loss-Absorbing Capacity (TLAC) for Global Systemically Important Banks (G-SIBs), or Minimum Requirement for Own Funds and Eligible Liabilities (MREL) in EU:

Banks must pre-issue a thick layer of bail-inable liabilities:

long-term debt,

subordinated instruments,

certain preferred stock.

This is presented as “ensuring banks can be resolved without taxpayer money”.

Translated:

Total Loss-Absorbing Capacity (TLAC) is “pre-positioned meat”: a pre-agreed stack of sacrificial liabilities ready to be written down or converted.

In Great Taking terms, this is preparing a wide, standardized funnel through which private claims can be erased and converted into equity in cleansed entities.

7. Client assets, custody, and “securities entitlements”

This is one of the most important bits.

Key Attribute on client assets / segregation is usually framed like:

Regime should ensure that client assets (securities, money) held by a firm are protected and returnable to clients, to the extent possible.

BUT:

They also recognize:

omnibus accounts,

securities entitlements under frameworks like US UCC Article 8 or their analogues,

and that in many jurisdictions, clients do not have a direct property interest in specific securities, only a pro rata interest in a pool.

Practical implications:

You are often not the legal owner of the share/bond/bar.

You hold a “securities entitlement”: a claim against your intermediary (broker/bank),

which has a claim against a higher-level intermediary (global custodian),

which is part of a pooled interest at the Central Securities Depository (CSD).

Confused yet? (Complexity by design)

In shortfalls, losses are shared pro rata across that pool, not borne by the intermediary alone.

In resolution, authorities can:

respect segregation “as far as the law and records allow”,

but if there are holes / mis-segregation / operational deficiencies → clients eat the shortage.

From the Great Taking lens:

The combo of omnibus pools + “securities entitlements” + resolution powers is exactly what David Rogers Webb described:

Your ETF/broker “ownership” is a claim in a pooled structure, not a direct title to specific assets.

In resolution, the systemically important part of the pool (e.g., collateral posted at CCPs, gold in ETF vaults) can be prioritized / re-titled to CCPs/Central Banks,

and residual claims of end-clients can be haircut, restructured, or paid out in new paper (CBDC units, resolution fund claims, long-dated bonds).

The Key Attributes themselves don’t say:

“We’ll seize ETF gold and pay you back in CBDC at old prices.”

They say:

“Protect client assets and ensure clarity on who owns what; where assets are pooled, develop transparent rules, and in resolution, ensure that clients are treated fairly and consistently with insolvency outcomes.”

But given:

the dematerialized, pooled, rehypothecated custody stack,

and my assumption that the Controllers want a Great Taking,

the legal framework the Key Attributes demand is perfectly compatible with:

Keeping CCPs/CSDs and big custodians whole as systemically vital,

Using bail-in / loss allocation at the level of member firms and their clients,

Wiping a large share of “paper gold” and other claims while the metal/collateral stays inside the system.

8. Cross-border recognition: no easy escape

A huge part of the Key Attributes is about cross-border “effectiveness”:

Home and host authorities should:

Cooperate in Crisis Management Groups (CMGs),

Enter into cooperation agreements,

And have laws that allow recognition of foreign resolution actions.

This leads to:

Statutory recognition regimes in some countries:

“If the home authority bails in this liability, our courts will recognize it.”Requirements that contracts include recognition clauses:

e.g., banks issuing debt under foreign law must include language where the creditor contractually agrees that their claim can be bailed in by the home resolution authority.

Great Taking angle:

This is about removing the jurisdictional escape hatch.

You don’t want banks and brokers to put key liabilities under foreign law that might block bail-in or allow creditors to sue elsewhere.

Key Attributes push everyone toward:

local recognition,

contractual submission to foreign bail-in,

and Crisis Management Group coordination.

So when a systemic event hits:

bail-in and resolution actions travel through the network cleanly,

your claim doesn’t magically escape because the bond is governed by English law or NY law.

9. Funding in resolution: how to keep the zombie moving

Key Attributes also insist that jurisdictions have a backstop for funding firms in resolution:

Resolution funds (industry-financed),

Government-backed credit lines,

Central bank facilities.

But always with the principle:

First: losses on shareholders and bail-inable creditors,

Then: maybe use resolution fund / public backstop to stabilize critical functions.

Translation:

This is the “stability > truth” piece:

You need enough backstop to keep the cleaned-up institution running,

but you want political cover that “private investors took the pain”.

The Great Taking is not “kill everything”; it’s:

consolidate assets at the top,

wipe a layer of claims,

re-float a safer, more controlled, recapitalized core.

Key Attributes give the doctrinal language for that.

10. Financial Market Infrastructures, CCPs, and CSDs: the collateral spine

Later annexes of this document added guidance on Financial Market Infrastructures (FMIs):

Central Counterparty Clearing Houses (CCPs), Central Securities Depository (CSDs), payment systems.

Core idea:

These are too central to be allowed to fail disorderly.

Resolution regimes must ensure:

continuity of critical clearing/settlement,

clear loss allocation rules (e.g. haircutting margin, assessments on members),

and tools to restructure ownership/governance.

This is where the “paperization / collateral consolidation” meets the plumbing:

Most paper gold, securities, derivatives, and collateral chains run via CCPs and CSDs.

Key Attributes essentially say:

CCPs/CSDs will be preserved and supported,

members and clients will eat losses via pre-defined loss allocation and recovery tools.

In Great Taking terms:

The plumbing core (CCPs/CSDs) is sacrosanct.

You never let them fully fail; you’d haircut members, clear out their equity, bail in their debt, and if needed, migrate client positions/assets into new structures.That’s consistent with:

The entities that hold and track the real collateral are protected,

The layers of claims around them are what gets expropriated / re-written.

11. Recovery & resolution planning: pre-mapping the sweep

Key Attributes also force:

Recovery and Resolution Plans (RRPs) – “living wills”:

Firms must map:

critical functions,

legal entity structure,

booking models,

inter-affiliate exposures,

where client assets sit,

dependencies on Financial Market Infrastructures and IT, etc.

Resolvability assessments:

Authorities periodically assess whether a firm is “resolvable” under the Key Attributes and demand changes (simplification, subordination, clean holding companies, etc.).

Translated:

Living wills are attack maps:

They tell resolution authorities exactly:

where to cut,

how to transfer,

which liabilities to bail in,

which legal entities hold which asset pools.

That’s not a conspiracy; it’s literally their stated purpose:

“Make sure we can resolve you without chaos.”In a Great Taking + Freegold scenario, these wills make a fast collateral sweep feasible over a weekend instead of over years.

12. Putting it together in the Freegold + Great Taking model

Now combine:

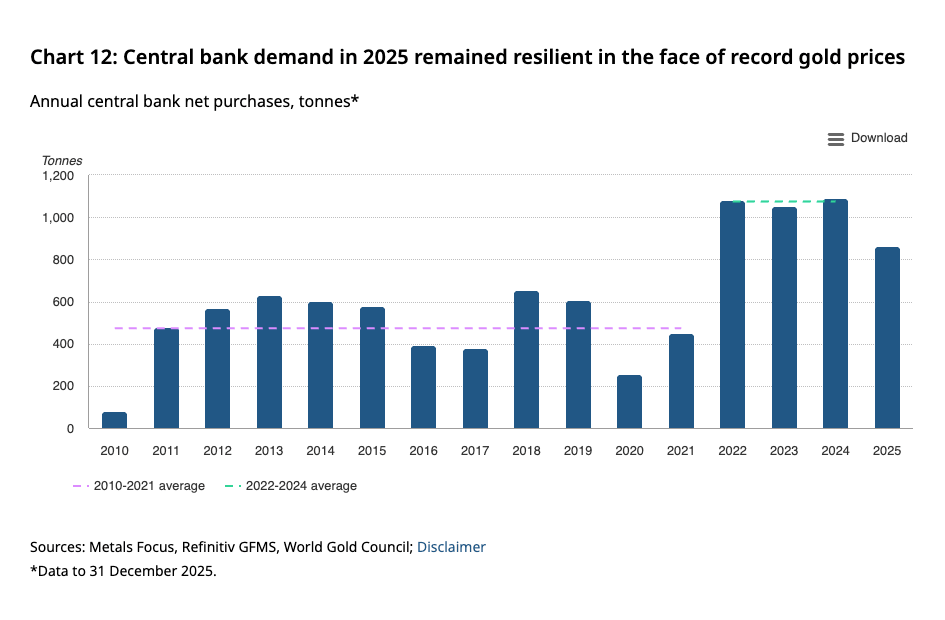

Central Banks accumulate physical gold,

later revalue it massively as inter-sovereign settlement collateral.

legal + plumbing regime that wipes/locks paper claims and consolidates underlying collateral inside system/sovereigns.

under-injection of liquidity + refi wall → accident → “Solution weekend”.

In that frame, the FSB Key Attributes are the legal playbook for the “Solution weekend”.

Rough path:

Pre-crisis decade:

Key Attributes implemented nationally: BRRD, OLA, TLAC/MREL, FMI resolution regimes.

Banks/CCPs/CSDs forced to:

issue bail-inable debt,

clean up legal structures,

produce detailed living wills.

Custody digitizes; “securities entitlements” and omnibus accounts become standard.

Debt/Liquidity corner:

Under-injection of liquidity + refi wall.

Accident: bank(s), broker(s), CCP(s) under stress.

Resolution trigger under Key Attributes:

Authorities declare key firms “failing or likely to fail”.

Activate resolution instead of ordinary bankruptcy.

Freeze & stays:

Temporary stay on close-outs, collateral grabs.

Trading halts, redemptions/gates on certain funds, ETFs, etc.

Collateral & function consolidation:

Transfer critical functions and good assets (including high-quality collateral, potentially physical metal backing ETFs/unallocated accounts) to:

bridge institutions,

new entities partly controlled by state/Central Bank.

Financial Market Infrastructures (CCPs/CSDs) kept whole and supported:

loss allocation through member sweeps,

restructure governance/ownership as needed.

Great Taking of paper claims via bail-in:

Shareholders wiped.

Bail-in of subordinated and senior unsecured debt, maybe some wholesale deposits and structured products.

Client asset shortfalls (especially in rehypothecated/omnibus chains) crystallize; clients get:

reduced entitlements,

long-dated claims on resolution funds,

or CBDC-denominated IOUs.

For paper gold / ETFs / unallocated accounts:

Vaulted metal and related collateral kept inside CCP/CSD/CB perimeter.

Investors get:

cash or CBDC at pre-revaluation or “stabilized” prices,

or “gold-linked” tokens with caps and frictions.

The system ends up with a bigger share of true physical.

Mark gold to Freegold level:

Once dust settles and Central Banks/sovereigns hold more metal:

allow or engineer a major gold repricing.

Central Bank balance sheets heal via gold revaluation.

Offer gold-linked instruments to other Central Banks/SWFs (not to households).

New regime:

Retail/institutional savers mostly hold:

CBDC / deposits,

restructured securities,

state-approved wrappers.

Central Banks & sovereigns hold:

much larger share of physical gold,

high-quality collateral,

control over Financial Market Infrastructures.

Key Attributes remain as standing doctrine for the next sweep.

The FSB Key Attributes are the codified rulebook that makes step 3–6 legally clean, cross-border, and fast.

13. So what do you actually need to internalize?

If I compress this to “what you need to know for your own positioning”:

Resolution beats bankruptcy.

For any systemically relevant institution holding your assets, assume administrative resolution, not a court process, in a crisis.

That means:

speed,

limited appeal in the moment,

heavy reliance on their valuations and hierarchy choices.

You often hold a “securities entitlement”, not the asset.

Shares/ETFs/bonds at a broker ≠ your personal property at the Central Securities Depository.

In resolution:

CSD/CCP layers are protected as Financial Market Infrastructures,

your entitlement sits at the level where losses are allocated.

Bail-in is the default loss-allocation mechanism, not an exception.

Equity + Total Loss-Absorbing Capacity + certain senior liabilities are explicitly designed to be vaporized or converted.

That’s not conspiracy; it’s the whole point of Total Loss-Absorbing Capacity (TLAC).

Cross-border arbitrage will be much harder than people think.

Recognition regimes and contractual bail-in recognition clauses mean:

“my bond is under foreign law” isn’t a guaranteed escape.

CCPs/CSDs and Central Banks are the structural winners.

In any Great Taking event consistent with Key Attributes:

Financial Market Infrastructures survive and get supported,

central banks/special entities end up owning more and better collateral.

Paper gold & paper claims are in the sacrificial layer.

Key Attributes don’t mention gold, but:

gold parked in systemic channels (banks, ETFs, unallocated) sits inside the resolution perimeter,

physical gold in your direct possession does not.

Living wills = pre-mapping for the sweep.

All the complexity needed to do a high-speed Great Taking is being pre-analyzed and cleaned up under the banner of “resolvability”.

14. Final TL;DR

The FSB Key Attributes are the global meta-blueprint for how to:

freeze,

seize,

haircut,

convert,

and re-float financial institutions and FMIs,

in a way that:

protects funding, collateral, and core rails,

lets private investors/creditors eat losses,

limits obvious “taxpayer bailouts”,

and keeps the system operable.

Under my Freegold + Great Taking assumptions:

This is the legal superstructure that makes the collateral sweep feasible.

It doesn’t say “we will steal your gold”; it sets up a world where:

“your gold” in systemic channels is a claim that can be re-written in resolution,

while the underlying metal and core collateral pools are conserved and can later be revalued on sovereign/Central Bank balance sheets.

Translated:

Treat all pooled, custodied, intermediated paper as part of the sacrificial layer of a Key Attributes-style resolution regime.

Treat physical self-custody assets (gold, BTC, Monero, etc.) as outside that specific machinery, but still targetable via taxes, reporting, and liquidity controls.

Assume that in the next big Debt/Liquidity accident, the Controllers will use exactly this resolution toolkit before any explicit Freegold-style revaluation move.

The Controllers win if the financial system doesn’t fail, however, they win even more if the financial system fails.

The question then becomes: When are they going to fail the financial system?

The “Key Attributes” really are that the game is rigged and the only way for you to win long-term is to not play.

More context: