Why I think the government created Bitcoin (and a few predictions)

Why I think the Controllers created Bitcoin and more importantly my predictions for how the next few years unfold.

In this article I’ll cover why I think the Controllers created Bitcoin and more importantly my predictions for how the next few years unfold.

I think it’s very likely we got got.

To be clear, I don’t have any “smoking gun evidence” that the government created Bitcoin. I’ll take you to pattern-matching land.

I’ll lay out indicator clusters — meta-layer tells that lean toward “Bitcoin was authored or at least green-lit by the Controllers”.

Obviously, I’ll have to make many assumptions, some of them are going to be correct, and some are likely going to be wrong.

This is not going to be 3D chess, it’s probably going to be 10D chess. Not because it’s very complicated, but because I have to introduce many angles you’re probably not familiar with.

I am DCA-ing into Bitcoin. I have not deserted. If the price drops, I’ll be buying more.

Not because I am bullish on the fiat-denominated price short-term, but because I am not convinced the financial system won’t get sacrificed for CBDCs and Digital ID to get installed.

I am not going to be proposing any “solutions” in this article. We can theorize in another article plus I don’t have an optimal solution.

The “solution” is probably closer to “be more Amish”, instead of buy XYZ asset.

The Coordination Tax

I’ll first briefly explain the Coordination Tax.

Three Stacked Systems

S₀ Protocol: consensus rules, Proof-of-Work, supply.

S₁ Policy: relay/mempool defaults, mining templates, wallet behaviors.

S₂ Perimeter: banks, clouds, app stores, ISPs, payment networks, tax law, PR.

Security: S₀ is math; S₁/S₂ are sociotechnical.

Tax: recurring human + legal + distribution cost to keep S₁/S₂ aligned with S₀’s ideals.

Attacker asymmetry: One cheap perimeter tweak (Acceptable Use Policy line, bank heuristic, pool template) can shift millions. Defenders must hold all fronts, all the time.

I’ve written more about the Coordination Tax in this article.

Is Bitcoin’s design Controller-aligned?

First: Real constraints on “ControllerCoin”

If I am the Controllers in 2008:

I cannot:

Ship something obviously centralized (explicit council, arbitrary inflation).

Ship something obviously state-branded.

Make home nodes clearly impossible from day 1.

Make the protocol layer (S₀) so ugly that the sharpest people instantly fork to a clean adversarial chain.

I must:

Give early cypherpunks enough “purity” that they adopt it.

Embed hooks whose consequences only fully show up 10-20 years later.

Ensure that capture at Policy (S₁), Perimeter (S₂) is easier than exit via Protocol (S₀) fork.

Exploit:

human nature (convenience, status, yield),

coordination tax,

app stores and banks (S₂),

“neutral” standards and dev culture (S₁).

Examining Bitcoin’s protocol design

At the protocol layer (S₀), Bitcoin as it actually exists is already extremely close to optimal for a Controller-grade pressure valve.

Most of what the Controllers would want to do does not require a different coin; it just requires:

post-hoc capture of S₁ (policy, clients, dev culture), and

weaponization of S₂ (banks, cloud, app stores, law, PR).

So the “design differences” are mostly not in changing Satoshi’s code.

Given the stated constraints:

S₀ Protocol: must look maximally adversarial and “hard money”.

S₁ Policy: must be steerable by a narrow epistemic priesthood.

S₂ Perimeter: must be tilt-able toward custodial, surveilled, programmable corridors.

What would I actually do as Controllers in 2008?

S₀ Protocol design: very close to BTC

21M hard cap, no explicit tail, supply-schedule meme simple and clean.

PoW like SHA-256:

CPU-mineable at start,

naturally ASICable later,

with manufacturing choke-points in a small number of jurisdictions.

Conservative blocksize, conservative script:

enough to do money,

enough to invite future “scaling” dramas,

not so messy that early devs balk.

In other words: Bitcoin as we actually got it is very close to what I’d choose.

If I’m the Controllers:

I quietly fund / support:

one canonical full node implementation (Core),

one canonical “serious” wallet and mining stack.

I accelerate:

professionalization of dev:

grants,

companies around the core team,

integration with regulated exchanges.

I deliberately shape norms:

“This is the client exchanges and big services rely on” → economic gravity.

“Security patches must be deployed quickly” → upgrade obedience.

In practice, somebody did fund, coordinate, and socially anoint a small dev set.

Whether that was the “Controllers” or just path-dependence doesn’t change the structural point: there is de facto a narrow S₁ priesthood.

So ControllerCoin’s S₁ looks like BTC’s S₁ as actually implemented, not the idealized “many independent clients” version.

There are *very few* S₀ changes that help the Controllers more than they hurt. The strongest Controller design is: “Bitcoin’s Protocol S₀, captured via Policy S₁/Perimeter S₂, on an optimal timeline”.

Every time I try to invent a radically better S₀ controller coin under my constraints, I either:

damage early adoption and invite a cleaner fork, or

rediscover patterns that BTC evolved into anyway.

S₀ (Bitcoin’s protocol) ended up almost perfectly placed:

Sound money meme with 21M cap.

Public, analyzable ledger.

PoW that naturally centralized hardware.

Blocksize, script, and governance story that generated just enough internal conflict to prevent ossified consensus on any one “pure” vision.

Much of the serious Controller leverage lives in S₁/S₂ anyway:

S₁:

reference client dominance,

mempool policy,

social anointing of “serious devs”.

S₂:

KYC ramps,

banks, app stores,

ETF/ETN/stable wrappers,

tax regimes,

In that light, BTC looks less like a pure outsider weapon and more like an error-asset that converged into near-ideal pressure valve form:

It channels “fiat is rotten” energy into:

speculation,

paper exposure,

narratives that can be domesticated.

It remains sufficiently self-custody-capable that a small minority can use it as an escape hatch.

But the default experience for most people is routable through Controller-grade rails.

So let’s ask the question:

“How would a more Controller-aligned cryptocurrency’s design differ from Bitcoin while still enabling the Controllers to achieve their goals?”

At the code level (S₀): almost not at all.

Any obvious deviation that helps control later hurts adoption early and risks a clean fork. Bitcoin’s actual S₀ is near-optimal for a pressure valve under my aforementioned constraints.

Arguably, the real differences lie in:

Timing:

how fast ETFs, stables, and KYC rails come online,

Funding:

who pays which devs and infra players early,

Narrative sequencing:

when “digital cash” quietly pivots to “digital gold”,

Perimeter policy:

when and how aggressively on/off ramps, app stores, and tax rules clamp down on Medium-of-Exchange usage.

These are tricky and I’ll provide more context later on in this article.

The revealed path since 2009 is already broadly in the direction I’ve written about in my other articles:

Medium-of-Exchange usage made painful/custodial.

Self-custody left as a niche, high-friction option.

Node operators and privacy tools framed as potential legal liabilities.

BTC present as:

a vent for anti-fiat sentiment,

a sandbox for policy,

a volatility sink,

and a negotiable piece on the board in a future FX/sovereign/collateral reset.

This is very surface level information. For us to dive deeper, I have to give you some more context on Freegold.

So to understand why I think the government created Bitcoin, I have to tell you about an anonymous person who left a bunch of predictions in 1997 forum posts that haven’t yet materialized.

I’ll cover why his predictions haven’t yet materialized and are very likely to in the not-so-distant future.

What even is Freegold?

We’ll have to talk about gold and how Central Banks view gold.

I am going to take ANOTHER’s work and adapt it to the current regime.

Feel free to read his posts directly. In my view, he is very likely to be some kind of an insider/insider-adjacent.

Freegold = separation of roles:

Fiat (and later CBDCs) = unit of account + medium of exchange inside each bloc.

Physical gold = ultimate wealth sink and inter-bloc settlement asset.

The two are decoupled: no fixed peg, no formal “backing”, no domestic convertibility.

Gold trades freely in fiat, and Central Banks:

Hold gold as a reserve asset.

Mark it to market on their balance sheets.

Do not promise Joe Public any fixed gold convertibility.

The dollar reserve system dies, not fiat itself:

The role of USD Treasuries as global savings + reserve asset collapses.

That role migrates to physical/tokenized gold between blocs.

Fiat survives domestically, just heavily devalued vs gold.

Repricing is massive:

Directionally, gold has to “digest” decades of accumulated surplus stored in dollar paper.

That implies an order-of-magnitude step up in gold’s real value, not a 20-30% rally.

Freegold = a one-time, controlled debasement event where the Controllers re-anchor the system’s collateral stack in physical gold at a much higher price, without admitting default, and without giving citizens direct access to that anchor.

How Freegold differs from the classic gold standard

Key differences

No fixed parity

Old gold standards: currency = redeemable at a fixed rate in gold.

Freegold: currencies float versus gold; Central Banks mark gold at market.

No public convertibility

Old: citizens can (in theory) turn cash into gold.

Freegold: citizens get fiat/CBDC; only Central Banks/sovereigns settle in gold.

Gold is reserve / settlement only, not Medium-of-Exchange

Gold doesn’t circulate as day-to-day money.

It’s a high-level collateral / wealth sink: CB ↔ CB, or large sovereign deals.

Paper gold system collapses or is neutered

LBMA unallocated, COMEX leverage, ETFs: all get restructured, defaulted, cash-settled or neutered.

Physical gold becomes the only thing that matters at the margin.

Euro architecture was built with this in mind

European Central Bank explicitly marks gold reserves to market on its balance sheet already.

That’s this anonymous user’s “tell”: they designed for Freegold decades ago.

Freegold is post-Bretton-Woods v2, not a nostalgic return to coins.

The Controllers’ use-case for Freegold + Great Taking

I’ve already discussed the Great Taking at length in other articles.

Treat the “Great Taking” as:

A systemic collateral / custody rug:

People discover their “owned” securities (ETFs, brokerage assets, deposits) are legally junior to pledgees and central-bank-secured creditors.

In a big refi/liquidity accident, collateral chains are reorganized; a chunk of “your” assets is:

haircut,

frozen,

or forcibly converted into some new claim tier (longer maturity / lower priority).

It’s not “everyone loses everything overnight” (too destabilizing); it’s:

10–40% haircuts in some products,

bail-ins at banks,

pensions forced into new instruments,

with a thin veneer of legality (prospectus fine print, CSD rules, resolution regimes).

You wake up to: “You never really owned what you thought. You owned a claim on a claim”.

Take the Controllers’ objective function literally:

minimize Σ (cost_of_control + career_risk + embarrassment + legal_exposure) − λ·legitimacy_depletion

subject to: funding, collateral, banks, housing, pensions, indices, regime risk, external balance.

Given that, what problem does Freegold solve for them?

Unpayable sovereign debt stack

Realistically, a lot of Developed Market debt will never be repaid in today’s purchasing power.

Open default or brutal austerity → Gross Consent product collapses, regime risk spikes.

Multi-polar funding & dollar fatigue theater

US monopoly on reserves is politically and geopolitically expensive, especially if you’re trying to pretend there is no One World Government.

Legitimacy erosion

“Fiat backed by nothing” meme is cheap and sticky.

A visible “hard anchor” is useful theater to restore some trust.

Freegold solves all three:

Revalue gold → Central Bank balance sheets suddenly look healthier (asset side explodes).

Sovereigns can inflate away debt quietly, while claiming the system is “backed by real assets”.

Gold gives a neutral, apolitical reserve asset across blocs, not controlled solely by the US (perfect for deglobalization theater).

Read this article for more context on our One World Government.

How the Great Taking fits in

Great Taking = collateral sweep:

Use dematerialized custody + bail-in + resolution law to seize control of underlying collateral in a crisis.

Paper claims (ETFs, securities entitlements, rehypothecated positions) get haircuts or are forcibly converted.

The real assets (including gold) end up on Central Bank/sovereign/resolution-vehicle balance sheets.

Then:

Freegold = revaluation after consolidation:

Once the system owns more of the true physical metal (via CB buying + collateral sweeps),

you can safely let gold “find its true price” and book the gains inside the state perimeter.

Sequence:

Great Taking = remove private layers over collateral.

Freegold = revalue collateral once the right hands own it.

Path from here to Freegold in the Debt/Liquidity cycle

I’ve already covered how Central Banks deliberately cause crises and inflation using the Debt/Liquidity cycle.

1) Pre-crisis prep

The Controllers quietly:

Load the system with cheap debt

Quantitative-Easing, Zero-Interest-Rate-Policy/Negative-Interest-Rate-Policy, “whatever it takes” decade.

4–7y maturities → refi walls in 3–7 years.

Push securities into:

CSDs (DTCC/Euroclear/Clearstream),

omnibus broker pools,

ETFs and index wrappers.

Encourage rehypothecation, cross-margining, “efficient markets”.

Accumulate gold at CB level

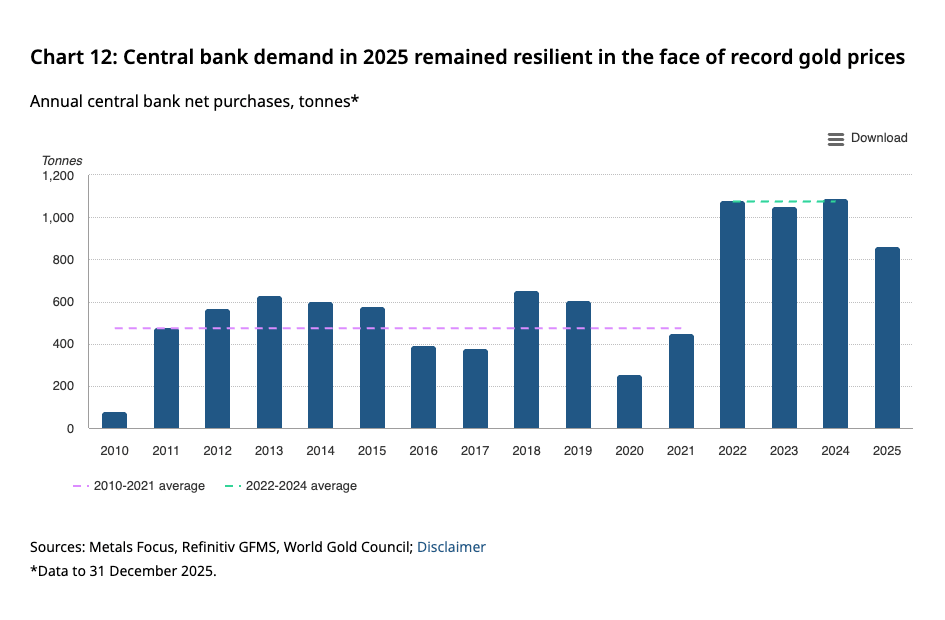

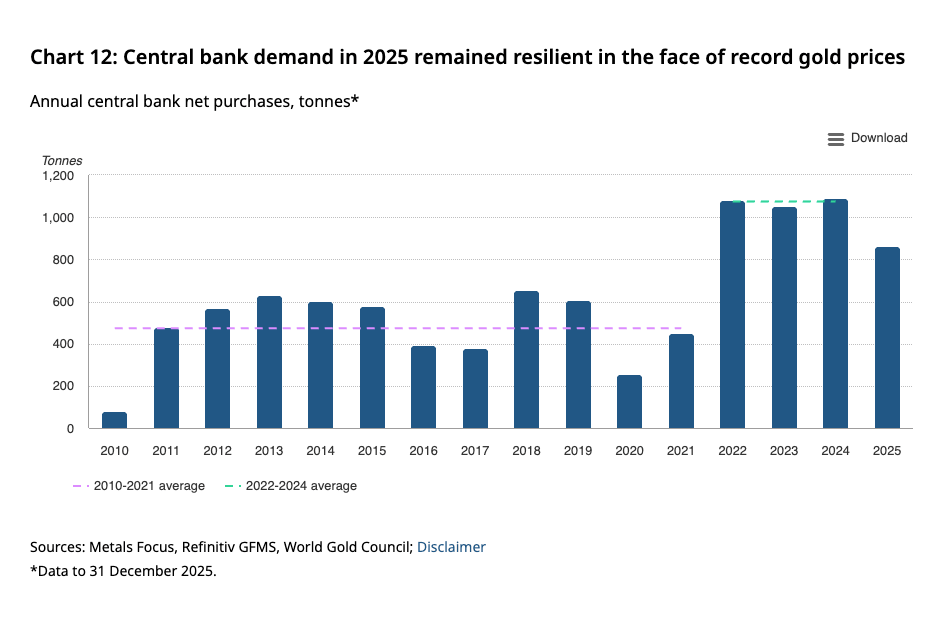

Record CB net buying in 2022–2023-2024 is exactly this.

EM/BRICS + stealth buying from China/Russia etc.

These are official statistics. There is significant unreported gold buying by Central Banks.

Grow the paper gold stack

Futures, options, unallocated accounts, ETFs.

Most held via securities entitlements, not as allocated bars in people’s name.

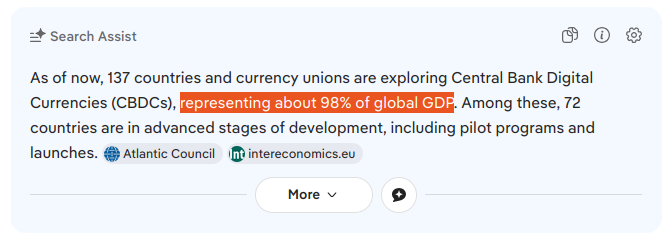

Lay digital rails

CBDC pilots, tokenized collateral, RTGS upgrades.

Rails agnostic to what’s underneath: USTs, MBS, or revalued gold.

(this step is very important)

Read my One World Government article for more context.

At this stage, nothing looks “Freegold”. It’s just “modern finance”.

2) Liquidity under-injection window

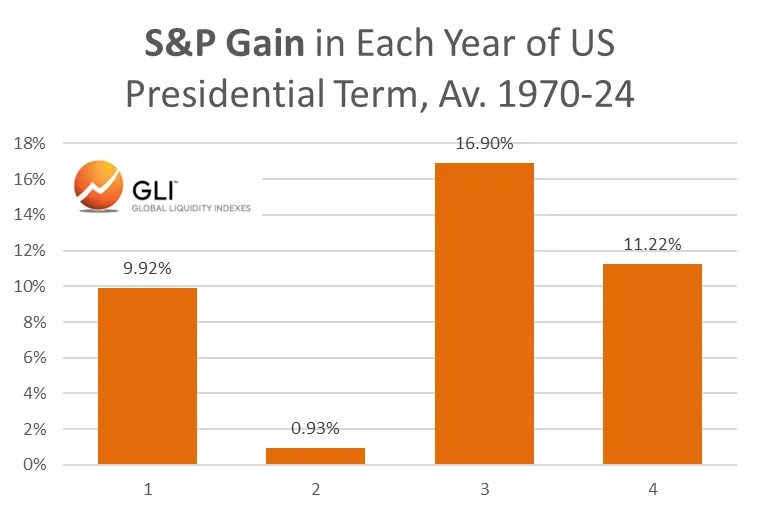

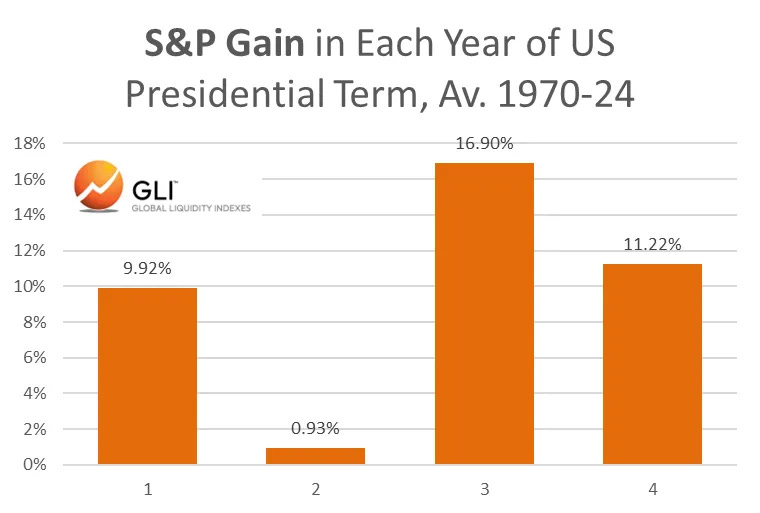

I am not telling you anything new but this happens during midterm years by default.

This is not a hard rule, just a default (there are too many variables). Here is a chart I stole from Michael Howell.

Then:

Net Liquidity impulse starts rolling over → “discipline regime”.

Real rates creep up, term premium rises, spreads widen modestly.

Narrative: “We’re serious about inflation; policy is restrictive; data-dependent” (or “Powell is sabotaging me”).

This is the midterm year sweet spot:

Best EPS growth, worst price returns = multiple compression.

Exactly when you’d want to:

cool asset froth,

force weaker players to de-risk,

test where refinancing breaks.

3) Accident & Great Taking

If they push liquidity under-injection (deliberately or not) too far relative to the refi wall:

Something snaps:

Sovereign funding wobble,

Big shadow credit blow-up,

Major bank/Central Counterparty Clearing (CCP) stress,

FX crisis.

The Controllers then:

Freeze key custody chains

Halt redemptions, pause ETF creations, gate funds.

Invoke emergency powers & resolution frameworks.

Prioritize the core

Protect Central Counterparty Clearing (CCP), systemic banks, sovereign funding.

Use bail-in/bail-out combos so that paper holders absorb losses, not the state.

Sweep collateral

Title to high-quality collateral (incl. gold backing certain ETFs, unallocated positions) migrates to:

Central Banks,

resolution vehicles,

sovereign funds.

Haircut / convert paper

Retail and fund investors get:

IOUs, long-dated bonds, or CBDC balances,

at some reference price before the later Freegold revaluation.

That’s the Great Taking: systemic legal rug on the entire custody stack, not a dude with a gun taking your coin (maybe a drone with a gun).

4) Freegold revaluation

Once the dust settles:

Let gold “go free”

Stop sitting on the price with paper leverage.

Possibly introduce new official pricing venues or auctions.

Either way, allow a step change up in gold’s price.

Mark Central Bank gold to market

Suddenly, sovereign/Central Bank balance sheets have a huge asset-side gain.

This is the “silent default”: liabilities (currency + bonds) now backed by more valuable reserves, but in devalued units.

Wholesale CBDC + tokenized reserves + gold-linked instruments for official sector.

Retail gets CBDCs and bank deposits; no direct access to Central Bank gold.

Financial repression 2.0

Run moderate but persistent inflation.

Cap nominal yields below that.

Let real value of “legacy” debt bleed out.

Freegold is the narrative wrapper and balance-sheet plug for this patch.

What the post-Freegold world looks like

Assuming the Controllers pull this off more or less cleanly.

1) Monetary architecture

Domestic:

Fiat + CBDCs as Medium-of-Exchange/Unit of account.

Heavy KYC/ID, programmability, capital controls at the edge.

Inter-sovereign:

Gold as elite settlement/collateral.

Possibly tokenized in wholesale rails (inter-CB DLT systems).

Sovereign debt:

Legacy debt inflated away silently.

New issuance increasingly:

shorter duration,

more explicitly tied to gold-backed credibility in foreign investors’ eyes.

2) Role of gold in practice

Central Banks:

Don’t promise convertibility to citizens.

Use gold as:

collateral in swap agreements,

bargaining chip in geopolitics,

accounting buffer to absorb future crises.

Citizens:

See gold price screaming higher.

Are nudged towards:

gold-linked digital instruments,

taxed/regulated bullion markets,

narratives like “you don’t need physical; your CBDC is safer and ‘backed by the nation’s gold’”.

Gold flows:

Move quietly through official channels (central banks, sovereign funds).

Physical retail markets see:

higher prices,

more reporting,

tighter AML/KYC.

3) Rails & surveillance

CBDCs and ID rails become non-optional:

“To defend our new sound system, we must crack down on tax evasion, terrorism financing, and illegal gold/BTC flows.”

Governance OS / ISR / risk systems (Palantir, Microsoft, etc.):

Needed to:

monitor gold flows,

manage cross-border exposures,

model FX/gold/sovereign interactions,

enforce capital controls and sanctions.

Why didn’t his 1997 Freegold predictions materialize

I’ll go over how the Controllers managed to extend the USD game with China and Bitcoin as the two big “unexpected tools”.

1) What ANOTHER expected vs what actually happened

Roughly in ANOTHER terms:

Late 90s:

Dollar reserve system is already stretched.

Euro is about to launch with mark-to-market gold on the Eurosystem balance sheet.

Oil producers (especially in the Gulf) are sick of holding exploding piles of USD paper.

Physical gold flows are tight; paper gold stack (LBMA, COMEX, unallocated) is huge.

ANOTHER’s core expectation (compressed):

Step 1 – Euro launches with a gold-friendly architecture.

Step 2 – Oil quietly re-prices; flow of physical gold from West to oil runs through Europe.

Step 3 – Dollar’s external funding collapses as key players shift into euro + physical gold.

Step 4 – Dollar hyperinflation / Freegold reckoning: Central Bank gold revalued, USD reserve role breaks.

Instead, what we got:

The euro launched, but the dollar didn’t die.

Gold did rise structurally from 2001 onward, but not in the “one-shot Freegold” way.

The USD system metastasized into something bigger:

China as the ultimate vendor-financing reserve sink (“Chimerica”),

gigantic derivative / eurodollar stack,

post-2008 Quantitative Easing/Zero-Interest-Rate-Policy and global swap lines,

and later Bitcoin as a digital pressure valve.

From a Controllers-lens, the story is:

“We realized we could let ANOTHER’s script run and accept an early Freegold reset in the late 90s / early 2000s… or we could bolt on new actuators (China, derivatives, QE, BTC) and milk the dollar for another 20–30 years while quietly preparing the Freegold + Great Taking combination on stronger rails.”

2) Why extend the USD at all, if Freegold was the end state?

The Controllers faced a choice after the Cold War:

Option A – Early Freegold (ANOTHER timing)

Let gold reprice ~late 90s / early 2000s.

Dollar reserve role collapses earlier.

Debt pile is smaller, digital rails are primitive, legal bail-in architecture not ready.

Less collateralized paper to sweep (= smaller Great Taking).

Less convergence between US/EU/China systems; more chaotic multipolar transition.

Option B – Extend USD & build a bigger reset engine

Keep dollar hegemon alive through:

integrating China as manufacturing + reserves sponge,

blowing out global debt and derivatives,

harmonizing custody & collateral law (Dodd-Frank, bail-ins, CSD dominance),

digitizing everything (ETFs, street-name custody, dematerialization),

testing public tolerance with QE/ZIRP,

and later using Bitcoin as a decoy Store-of-Value + volatility sink.

End result:

much bigger paper stack to haircut,

more gold quietly relocated to Central Bank/sovereign hands,

hardened legal & digital rails for the Great Taking,

and a multi-bloc architecture (US/EU/China) ready to coordinate a Freegold-type rebase.

Given the Controllers’ objective function (“minimize control/career/legitimacy risk subject to funding/housing/banks/etc.”), Option B is obviously more attractive:

You avoid an early, chaotic USD crackup.

You buy time to:

consolidate gold,

centralize custody,

write bail-in law,

roll out CBDC-adjacent rails,

cultivate China as co-manager instead of an adversary.

So: extending USD = build a taller Jenga tower on purpose so that when it finally tips, you have a bigger, more controllable reset and a fatter Great Taking.

3) Extension engine #1 – China as dollar life-support and gold accumulator

3.1 The basic deal: “Chimerica”

The Controllers’ lens after the 90s:

US wants:

cheap imports,

suppressed goods inflation,

someone to buy endless Treasuries,

geopolitical leverage over industrial chains.

China wants:

export-led growth,

technology & capital inflows,

time to build domestic capacity and surveillance apparatus,

a way to turn sweat + coal into reserves and gold.

So the deal (often framed as “globalization” in official language) is:

US prints high-quality paper (USTs, Agencies, USD bank liabilities).

China prints low-wage labor, exports, and real goods.

China recycles the USD surplus back into US paper.

This does three huge things for the dollar system:

New reserve sink

Instead of oil producers and Europe being the only big USD recyclers, China becomes the main buyer of Treasuries and Agencies.

That massively extends the timeline on which foreign sector is willing to hold USD claims.

Imported disinflation

Offshoring + Chinese overcapacity leads to:

falling prices for tradable goods,

wage suppression in the West.

This offsets monetary and fiscal expansion:

You can run looser policy without headline CPI exploding.

That’s free cover to blow out the USD debt stack.

Political deniability

“It’s just comparative advantage and free trade.”

No one needs to admit, “We extended the dollar by turning China into a de facto dollar colony, then letting them become a co-controller.”

From a Freegold perspective, this delays the moment when:

surplus countries say “no more USD, give me physical gold instead”,

gold has to reprice to stop the flow.

Instead, China accepts the deal: “We’ll hold your paper longer, while we quietly buy metal and build our own rails.”

3.2 China as controlled shock absorber for dollar accidents

Whenever the USD system wobbles:

2001 dot-com bust →

Easy money + Chinese capacity + housing bubble instead of Freegold moment.

2008 GFC →

China launches a massive stimulus; sucks in commodities; anchors global demand.

US/euro Central Banks do QE + swap lines; China doesn’t dump Treasuries, holds the line.

Each time, instead of the world calling the USD bluff and rotating fully into physical gold, China + Central Bank coordination stabilize the structure. Every crisis that could have been a Freegold moment becomes instead:

“Another chance to extend USD life while building the future gold-aware multipolar system.”

4) Extension engine #2 – Derivatives, eurodollars and hyper-financialization

To extend the USD life past the ANOTHER window, the Controllers also needed new plumbing:

4.1 Shadow dollar & derivatives

Eurodollar system (offshore USD deposits, loans, swaps) lets dollar credit grow outside domestic constraints.

Interest rate swaps, FX swaps, CDS, futures allow huge synthetic positions:

transform duration (turn long bonds into short via swaps),

create synthetic “safe assets”,

suppress volatility via carry strategies.

Mechanism for extension:

Absorb foreign demand for “safe” yields

Instead of foreign savings going straight into gold or local assets, they go into:

USD bonds,

structured products,

synthetic exposures hedged with derivatives.

Mask true risk & funding fragility

Derivatives allow:

yield enhancement,

“risk transfer”,

hiding leverage across balance sheets.

That keeps apparent stability high, even as the real system becomes more fragile.

Paper gold stack

Gold futures, forwards, unallocated accounts, ETFs massively expand claims on gold without requiring matching physical.

This mutes the gold signal that ANOTHER thought would blow up the dollar:

People think they’re “long gold” but they’re mostly long dollar-denominated gold IOUs.

In the Controllers’ language:

Derivatives + eurodollars = “Error amplifier that we used as time-buying device.”

It let us:

turn the dollar into a global risk-on reference asset,

feed everyone more yield via engineered carry,

and delay the repricing that would otherwise force Freegold.

4.2 Why they let 2008 be a QE experiment, not a Freegold reset

2008 was arguably the perfect candidate for a Freegold moment:

USD collateral system seized up.

Shadow banking blew up.

Trust in banks, rating agencies, regulators cratered.

Instead of letting gold go “free” and restructuring the system, they chose:

QE: Central Banks absorb toxic assets and interest-rate risk.

Zero rates: keep the debt conveyor belt running.

Swap lines: knit together the dollar system globally.

No serious gold revaluation beyond a cyclical bull.

Why?

Legal/computing rails for the Great Taking were not ready.

Custody still too fragmented.

Bail-in frameworks barely built.

CBDCs not tested.

China still mid-transition; euro crisis brewing; Controllers fear a reset would hand too much chaos to actors they don’t fully control.

They realize they can get another cycle out of the USD by using:

QE as “liquidity morphine”,

new rules (Dodd-Frank, bail-in regimes) as Great Taking scaffolding,

more dematerialization (DTCC, Euroclear, Clearstream, ETF-ization).

So 2008 → extend and entangle:

Build more centralized custody.

Push retail out of certificates into street-name + broker/ETF units.

Normalize extraordinary liquidity (swap lines, CB facilities) as acceptable.

All of that sets up exactly the Great Taking architecture David Rogers Webb has described.

5) Extension engine #3 – Bitcoin as digital pressure valve & gold decoy

Bitcoin only appears after the GFC.

Let’s assume that Bitcoin was not created by the Controllers for a second.

5.1 Early BTC: “uncontrolled” error asset

2009–2013:

Satoshi’s thing is a curiosity; tiny market cap.

Probably not on many/any Controller dashboard.

Some IC people and technocrats notice the design properties:

digital bearer,

capped supply,

censorship-resistant flows.

No one “uses” it yet; it just exists.

5.2 Realization: BTC can soak anti-fiat energy

2013–2017, as BTC bubbles and crashes:

The Controllers gradually see a pattern:

Hard-money & anti-system crowd splits

Some go to physical gold.

A growing chunk goes to BTC.

Speculative mania channel

Periodic BTC/crypto bubbles absorb:

surplus liquidity,

frustration with banks,

“end the Fed” energy.

Data + surveillance honeypot

Exchanges are KYC/AML- captured.

Chain analytics reveals networks.

“Dissident” capital is more observable than physical cash or gold.

BTC becomes a useful parallel rail:

not core enough to threaten sovereign gold strategy,

but loud enough to distract and divide the hard-money crowd,

and rich enough in datapoints to map dissidence and capital flight paths.

5.3 Containment: BTC as managed Store-of-Value corridor

As BTC matures:

Futures (CME), options, basis trades, GBTC, then ETFs → heavy paperization.

Regulatory gating:

KYC on major on/off ramps,

Travel rule for VASPs,

AML pressure on mixers & non-KYC wallets.

Resulting effective regime:

Medium-of-Exchange (payments) side:

progressively frictioned:

taxes,

reporting,

merchant risks,

app-store hostility to non-KYC wallets.

Store-of-Value side:

tolerated in a corridor:

excitement allowed,

ETFs/notes/derivatives soak demand,

big players can trade it as “digital gold”.

5.4 Why does this extend the USD/fiat regime in a Freegold world?

It splits the “exit” demand.

Instead of everyone fleeing into physical gold (which would accelerate Freegold timing), a meaningful fraction flee into BTC.

BTC does not directly deplete Central Bank gold reserves.

It even provides USD-denominated collateral for new derivatives.

It provides narrative cover.

When people say “fiat is dying”, policymakers can say:

“You have plenty of choices: stocks, real estate, gold ETFs, Bitcoin ETFs, stablecoins… see, the system is innovative!”

This dilutes the simple gold vs fiat binary ANOTHER implicitly relied on.

It adds to the Great Taking paper stack.

BTC held via:

ETFs,

brokerages,

custodial “yield” products,

is just another Street-name paper claim inside CSD/broker plumbing.

In a Great Taking, those claims can be:

gated,

cash-settled,

haircut,

folded into CBDC “recovery units”.

Self-custody BTC still exists at the edges — our “escape leak.” But as long as that cohort is small enough, the Controllers can tolerate it (and harass selectively) while using paper BTC as another tool to delay any decisive, gold-centric reset.

6) How all this served the Great Taking + Freegold combo

By extending the USD way beyond ANOTHER’s original window, the Controllers achieve several preparatory goals for Great Taking + Freegold:

6.1 Enormous expansion of paper claims

Extra decades of extended USD era =:

Massive growth in:

ETFs and funds,

structured products,

derivatives,

cross-border securities.

All:

dematerialized,

held via brokers and CSDs (DTCC, Euroclear, Clearstream),

legally framed as “securities entitlements” not direct asset title.

This is prime Great Taking feedstock:

In a crisis:

freeze the intermediaries,

prioritize Central Counterparty Clearing Houses (CCPs) and systemic lenders,

sweep collateral inside resolution vehicles and CB balance sheets,

leave end-holders with:

haircuts,

CBDC IOUs,

long-dated claims.

6.2 Gold re-consolidation & distribution

The extension period allows:

CBs and sovereign entities to:

buy or re-patriate physical gold,

unwind some legacy leases,

accumulate via off-market deals.

Private sector to:

accumulate paper gold (ETFs, unallocated accounts) instead of bars.

So by the time Great Taking + Freegold is enacted:

A larger share of the true physical sits in:

official reserves,

vaults under the control of system-critical entities.

A larger share of private “gold exposure” sits as claims in the very custodial system you intend to sweep.

Paper gold as sacrificial layer; physical as the prize.

6.3 Legal & digital rails hardened

The extra cycles post-ANOTHER gave time to:

Roll out:

bail-in laws, bank resolution regimes, CCP recovery plans,

cross-border harmonization of securities law,

standardized digital custody systems.

Normalize:

demat (no more bearer certs),

omnibus custody,

“street name” conventions everywhere,

centralized profit & risk in a few giant entities.

Pilot:

Real-Time Gross Settlement (RTGS) upgrades, wholesale Distributed Ledger Technology (DLT),

early CBDC projects,

digital ID and KYC rails.

When you finally do the collateral sweep (Great Taking), the path is:

“Flip legal switches → freeze pipes → reprioritize claims → sweep assets → reopen pipes with new CBDC & Freegold-aware regime.”

That’s only clean if custody and law are already consolidated. The USD extension era created exactly that.

7) Bitcoin split the “exit” demand exactly where the Controllers want

Imagine a world without BTC after 2008:

QE + ZIRP + moral hazard → hard-money anger goes almost entirely into:

physical gold,

maybe some silver, some miners,

small pockets of land/energy.

That accelerates physical drawdown:

CBs/bullion banks have to work harder to source bars,

paper vs physical tension shows up earlier,

LBMA/COMEX credibility cracks while Debt/Liquidity is still mid-cycle, not at crisis peak.

With BTC:

Same anger gets bifurcated:

“Boomers” & old goldbugs → coins/bars + GLD/ETC.

Millennials/Gen-Z/tech crowd → BTC/crypto, often instead of gold.

So:

Physical gold demand from angry young capital is diverted onto a synthetic rail they can fully surveil and later paperize.

CB bid for gold can be large and persistent without triggering a catastrophic retail scramble as early.

Net: BTC is a “gold demand splitter” that slows down the Freegold timetable, giving them room to:

Load the system with even more debt,

Finalize custody/legal/Great-Taking architecture,

Accumulate sovereign gold under the radar.

As the orange one would say: “Have fun playing with your Bitcoins“.

7.1. BTC as a programmable anger sink

Markets convert anger → P&L instead of riots.

BTC/crypto were elite-grade volatility sinks:

“End the Fed” energy: routed into leveraged perps and alt bags → countless little margin-call executions of would-be revolutionaries.

Every cycle:

People who would’ve bought physical bars instead:

aped into algo coins, NFT jpeg farms, dog memecoins,

got leverage-wiped,

ended up poorer and more psychologically exhausted.

The data from this is priceless:

Who moves first on macro scare headlines,

Who on/off-ramps to where,

Who ignores AML/KYC friction and uses sketchy corridors.

BTC is not just a “decoy asset”; it’s a behavioral honeypot.

7.2. TL;DR on Bitcoin’s design

Transparent ledger:

Perfect for chain analytics once you get KYC on major ingress/egress.

Heavily specialized hardware → energy footprint:

Easy environmental / AML attack surface.

Mining becomes permissionable (pools, large farms, energy contracts).

No built-in privacy; privacy as an add-on:

Most usage stays deanonymizable forever, especially via on/off ramps and clustering heuristics.

Social layer fractured & under-resourced.

Easy to portray as “bro tech / gambling / ransomware”.

All of this is great for the Controllers who want:

Paper-BTC rails inside CSDs and broker-custody plumbing to feed the Great Taking stack.

On-chain flow as a map of dissidence and capital flight.

A credible, but ultimately subordinate, parallel Store-of-Value narrative they can weaponize and cap.

7.3 The Coordination Tax as the kill-switch

The Coordination Tax = friction/inequality between:

“We must coordinate to really fork / rewrite / counter-capture BTC”, vs

“Most of us have day jobs, we’re ossified, we fear breaking our bags, we don’t share one ideology.”

The Controllers don’t need a protocol kill-switch; they need:

A social kill-switch:

Enough regulatory pressure,

Enough narrative division,

That the coalition willing to meaningfully change BTC (privacy default, etc.) never coheres.

BTC then asymptotically converges to:

“Digital gold” inside broker/CSD pipes,

Plus a thin, harassed, but not extinguished self-custody fringe.

That config is perfect for a Freegold + Great Taking world:

gold = state reserve anchor; BTC = psychological outlet & data exhaust.

Let’s go to pattern-matching land

With all this added context, let’s revisit Bitcoin’s design.

S₀ Protocol: consensus rules, Proof-of-Work, supply.

S₁ Policy: relay/mempool defaults, mining templates, wallet behaviors.

S₂ Perimeter: banks, clouds, app stores, ISPs, payment networks, tax law, PR.

S₀ Protocol looks almost too close to the optimal Controller spec

I already sketched this, but if we explicitly adopt “the Controllers designed it”, then Bitcoin’s base design hits a suspicious number of checkboxes:

1.1 Perfect “hard money cosplay” for the hard-money crowd

21M cap, halving schedule, transparent issuance

→ maximally meme-able “hardness”, easy for Austrians/goldbugs/End-the-Fed types to latch onto.

Proof-of-Work with simple, auditably random difficulty adjustment

→ looks adversarial to the state (burn electricity, compete for blocks, anyone can join).

If the Controllers wanted a digital decoy for physical gold, this is exactly the aesthetic they’d need:

harder, edgier, more futuristic than gold – so the young/technical hard-money crowd migrates there instead of to coins/bars.

1.2 Scripting + blocksize: just enough for “money”, perfect for future S₁/S₂ drama

Script is:

powerful enough to build custodial layers, multi-sig, LN, etc.,

but awkward enough that non-trivial contracts are painful on-chain.

1 MB blocksize (plus conservative culture) →

enough capacity early,

but guarantees a future “scaling war” where:

home-node purists and throughput pragmatists split,

users are nudged toward light clients and custodial services.

As a Controller design, that’s ideal:

Early years: cypherpunks can tell themselves they run full nodes, self-custody, “sovereign money”.

Later years: economic gravity + UX → S₂ Perimeter custodial capture while S₀ Protocol still looks pure.

1.3 No explicit governance & one obvious chokepoint

No on-chain governance, no formal council — just:

one dominant reference implementation,

one main repo,

a small priesthood of maintainers.

If I wanted something I can steer later without it ever looking “state-run”, this is what I’d build:

A protocol that pretends to be ownerless but in practice runs through a very small, socially-coordinated priesthood that can be influenced, co-opted, or replaced.

Taken together: S₀ (Protocol) is almost exactly what you’d sketch if you sat down in 2008 as “Controller design team” and said:

“Make me something that looks maximally adversarial, magnetizes hard-money dissidence, but guarantees S₁ (Policy)/S₂ (Perimeter) capture options later.”

2. The S₁ culture that emerged is weirdly Controller-friendly

Assume the Controllers didn’t just toss the code over the fence; they also seeded the culture around it.

Look at some emergent S₁ norms:

2.1 Extreme ossification meme

“Don’t change Bitcoin.”

“If in doubt, do nothing.”

Almost religious hostility to any on-chain change, even clearly defensive ones.

This is sold as safety (and is safety to a certain extent), but under my lens it also:

Makes it harder to fork away to a genuinely adversarial S₀ (Protocol) if S₁ (Policy)/S₂ (Perimeter) are captured.

Keeps the base protocol frozen in a form that is:

easy to surveil,

easy to run analytics on,

dependent on out-of-band layers (LN, custodial banks, L2s) where S₂ (Perimeter) can be weaponized.

2.2 Almost no serious thought leadership on regime-level threat modeling

The dominant big-name narratives inside BTC:

“Number go up.”

“Hard money vs fiat.”

“Digital gold.”

“HODL.“

3. S₂ Perimeter was built out with suspicious speed and coordination

If BTC were truly an unplanned insurgent threat, you’d expect:

years of denial/disarray,

fractured responses,

more genuine attempts to outlaw it.

What we got instead:

3.1 Early, globally coordinated KYC/AML standardization

VASP concept, FATF travel rule, harmonized KYC/AML expectations across major jurisdictions.

Exchanges rapidly pulled into licensed, surveilled perimeters.

That’s unusually fast global coordination for a supposedly “tiny toy asset” in the early 2010s. It looks less like “scrambling to react” and more like:

Controllers executing a pre-existing template for how any new rail gets turned into a surveilled perimeter: KYC on the on-/off-ramps, plus standardized data exhaust.

3.2 Chain-analytics industrial complex

Law-enforcement-adjacent firms built early and nurtured (Chainalysis, Elliptic, etc.).

Massive contracts with agencies; effectively co-sourced investigation capability.

If the Controllers expected BTC-like rails to emerge, this looks like the “monitoring module” arriving right on schedule. If they seeded BTC themselves, it’s even cleaner: build the ledger + build the analytics simultaneously.

4. The macro timing lines up too cleanly with Freegold/Great Taking prep

Under the Freegold lens, the key wins for Controllers are:

delay any retail stampede into physical gold,

quietly accumulate gold at CB level,

build Great Taking infrastructure in the securities/custody stack,

keep the USD/fiat regime alive until that architecture is complete.

BTC’s timeline is unusually helpful to that project.

4.1 Launched directly into the GFC → QE era

2008–09: acute delegitimization of banks/fiat.

Perfect moment to inject a digital “harder than gold” narrative that:

channeled the most intense “End the Fed” energy,

into something that does not touch CB gold stock at all.

4.2 Mania waves line up with critical “debt + legitimacy” moments

We then get big BTC/crypto waves:

2013

2017

2020–21

Each one:

soaks speculative anger,

splits the hard-money crowd (gold vs BTC),

reinforces “look, the system offers alternatives – we’re so innovative!”

Meanwhile, in the background:

CBs accumulate gold,

dematerialization / entitlements / CSD dominance deepen,

legal architecture for bail-ins, resolutions, and collateral sweeps hardens.

If BTC is random, this is nice for the Controllers. If BTC is designed, it’s exactly what you’d script: periodic digital manias that delay a pure Freegold rush and thicken the paper stack for the Great Taking.

5. ASIC & mining chokepoints are oddly convenient

From a Controller design desk in 2008:

“Give me a ‘decentralized’ consensus that eventually depends on a tiny number of fabs and a few jurisdictions.”

Reality:

Mining began as CPU/GPU → perfect to bait cypherpunks.

Then naturally converged on ASICs:

specialized hardware,

enormous capex,

tied to a handful of fabs (TSMC, Samsung),

and power/land in a handful of states.

Now:

Pressure on energy policy,

talk of “mining is climate-unfriendly”,

routine threats to regulate/ban mining in certain regions.

If BTC were designed by the Controllers, this is elegant:

Early phase: looks permissionless and egalitarian.

Mature phase: hashpower depends on industrial facilities heavily exposed to:

local regulators,

grid authorities,

export controls,

physical surveillance.

You get the symbol of decentralization with a very real, physical chokepoint for later pressure if BTC misbehaves relative to the Freegold/CBDC regime.

I’ve already covered how centralized Bitcoin mining is.

6. Narrative migration: from “P2P cash” to “digital gold”

Original whitepaper: electronic cash.

But almost all contemporary system-approved messaging is now:

“digital gold”,

“inflation hedge”,

“store of value”,

“long-term savings vehicle”.

That shift:

Makes BTC less threatening as MoE (day-to-day competitor to CBDCs/fiat),

Maximizes its usefulness as:

gold demand splitter,

speculative asset bubble,

wealth-effect toy for a subset of the population.

If the Controllers authored it, this is precisely the narrative arc you’d want:

Phase 1: cash story, to attract cypherpunk engineers and libertarians.

Phase 2+: quietly push the “digital gold” meme via:

institutional research,

macro influencers,

ETF issuers,

until the hegemonic mental model is:

“this is your digital bar of gold in a brokerage wrapper.”

That narrative keeps Freegold for states, digital gold for plebs.

7. BTC now plugs perfectly into Great Taking plumbing

Under the Great Taking model, the target is paper claims in CSD/broker custody, not the underlying assets.

Look at BTC’s trajectory:

Early: raw UTXOs, self-custody – Great Taking-resistant (similar to physical gold in your hand).

Later:

Custodial exchanges,

BTC futures,

trusts (GBTC etc.),

now spot ETFs and ETPs sitting at DTCC/Euroclear levels.

That means:

A huge and growing fraction of BTC exposure is now:

“securities entitlements”,

held in street name,

inside the exact custodial and legal architecture the Great Taking targets.

If the Controllers designed BTC as a Great Taking-compatible asset, this is what they’d aim for:

Make sure that, by the time BTC is big enough to matter, the majority of it sits inside brokers, funds, custodians and ETFs that can be:

gated,

cash-settled,

haircut,

or converted into CBDC units.

And the subset that stays self-custodied?

Annoying leak,

but small enough to harass with:

AML,

capital controls,

windfall taxes,

liquidity constraints on off-ramps.

That’s near-perfect alignment with the “paper vs physical gold” split, except mirrored:

“Paper BTC in ETFs/custody = sacrificial layer.”

“Self-custody BTC = tolerated leak like physical gold.”

8. BTC performs exactly the “gold demand splitter + anger absorber” role I described

If the Controllers in 2008 did a Freegold macro whiteboard, they’d want:

A digital sink for anti-fiat anger

So QE/ZIRP outrage goes into something that doesn’t attack CB gold or sovereign collateral.

A generational wedge within the hard-money crowd

Boomers & trad goldbugs: coins, bars.

Millennials/Gen-Z/techies: BTC/crypto.

A big data honeypot

Every “opt out” transaction goes through KYC exchanges and chain-analytics.

A paper stack

So BTC can be:

rehypothecated,

used as collateral,

folded into the Great Taking with other dematerialized claims.

That’s… exactly what happened.

As an indicator, not a proof:

The fit between “what BTC actually did in macro-sociological terms” and “what a Freegold-aware Controller would want a decoy asset to do” is very tight.

9. Counterfactual world: what would look different if BTC were truly insurgent?

Imagine a world where BTC was genuinely not a Controller project and Controllers only reacted late.

You’d more likely see:

Much harsher early attempts to outlaw it;

Less global regulatory coordination:

more patchwork rules,

slower emergence of travel rule-style harmonization;

More aggressive attempts to build official “StateCoin” alternatives earlier, to crowd it out;

Weaker institutional adoption:

real reluctance to give it ETF wrappers,

longer delay before big custodians take it;

Heavier direct push into physical gold in official narratives if they were truly terrified of BTC stealing that role.

Instead, we see:

BTC corralled into exactly the regulated perimeter you’d build if you were comfortable with it as a honeypot / decoy, not as an existential threat.

CBs buying record levels of gold, not BTC.

Gradual, careful ETF approval once every surveillance/paperization tool was ready.

That delta between expected “insurgent treatment” and actual “frenemy & wrapper” treatment is a meta-layer tell.

The probability that a random outsider invention would line up this closely with the Controllers’ needs is, in my own model, low enough that I lean “Controller-seeded or at least Controller-green-lit at inception”.

When are they going to pull out the Quantum FUD?

I’ve already covered how Quantum FUD is in the cards for Bitcoin in the not-so-distant future:

I am not a believer in Quantum computing. I think it’s just another government-created scam, however, I also think that it will be largely irrelevant whether Quantum can be engineered to scale cheaply and reliably enough to be broadly useful because the incentives line up almost too perfectly.

Let’s assume for a moment that:

Freegold (+ my Great Taking interpretation) is roughly right.

Quantum threat to Bitcoin does not need to be technically real to be weaponized – “Quantum FUD” is a policy lever, not a lab result.

Given that:

When in that arc is it optimal for Controllers to pull the “Quantum kills BTC” narrative lever, and what are the knock-on effects for BTC, Freegold, CBDC rails, and the Great Taking?

What Quantum FUD is for in this architecture

In this stack, the Controllers already have:

Freegold as the official hard-asset anchor between blocs (CB gold revalued, CB-to-CB settlement).

Great Taking as the legal/plumbing mechanism to strip collateral from private-paper stacks and consolidate it at the top.

CBDCs + ID rails as the retail Medium-of-Exchange/Unit-of-Account and surveillance spine.

BTC as leaky, increasingly paperized, used as:

volatility sink,

expropriation hedge for a minority,

grey/adversarial rail in some blocs.

So what can Quantum FUD specifically buy them?

Delegitimize BTC as “ultimate SoV” at the exact moment they need people to accept Freegold + CBDC as the new safe architecture.

“Sorry, cypherpunks – quantum breaks ECDSA, your coins are at risk; our new sovereign-grade vault + CBDC infrastructure is the only safe harbor now.”

Justify regulatory lock-in and perimeter tightening.

“We must migrate all crypto systems to post-quantum KYC’d rails; only regulated custodians can safely handle key upgrades / migrations.”

Create a flight to state rails during the Great Taking / reset turbulence, and then freeze people where they land.

Panic → on-ramps into CBDCs, ‘tokenized gold’, regulated stables → “temporary protections” → permanent capital controls.

Potentially seize a chunk of on-chain BTC under the guise of “protective migration” or “quantum risk remediation”.

“We need to move exposed outputs to secure state-managed multi-sig/post-quantum vaults, otherwise they’ll be hacked by hostile actors.”

So: Quantum FUD is not really about physics; it’s a narrative + regulatory + plumbing event that:

herds flows into the new rails,

breaks the BTC = untouchable Store-of-Value meme at the retail/elite-PM level,

gives cover for heavy-handed controls in a “public safety” wrapper.

Read this article for more context on the upcoming Quantum FUD.

In other words, the “ideal” window for them to pull out the Quantum FUD is roughly:

Around the Great Taking / reset window itself or shortly after the major shock, when:

Debt/Liquidity accident has just forced systemic bail-ins/freezes,

Freegold revaluation is being introduced as the stabilizing anchor,

and they want to trap fleeing capital in those official channels.

Once the collateral sweep is underway and gold/CBDC rails are ready, they can funnel panicked capital into their “quantum-safe”, KYC’d rails, stigmatize self-custody BTC, and lock the new regime in under the dual banner of “financial stability” and “cyber/quantum security”.

If Freegold is roughly right, what signs would we be seeing?

Let’s assume that ANOTHER was correct but early.

I’ll cover why I think we are already well into the set-up phase of a Freegold + Great Taking arc.

We have:

Very strong Stage-1 Freegold tells (CB behavior, euro accounting, dedollarization, CBDC rails).

Solid Great Taking scaffolding already in place (custody/entitlement law, bail-in regimes, CSD concentration).

No visible Stage-3 “gold as open sovereign settlement anchor” move yet.

If Controllers were running a Freegold + Great Taking script, what would we see?

Their playbook needs three big phases:

Phase A — Pre-positioning (Quiet Setup)

They would:

Move gold into official hands & ring-fence it

CBs as heavy net buyers of physical gold, not sellers.

Repatriation from foreign vaults.

Accounting that explicitly marks gold to market (euro architecture).

Legal/operational nudges so more of the global gold stack sits in:

ETFs,

bank custody,

bullion banks,

central securities depositories (CSDs),

rather than in household sock drawers.

Harmonize the Great Taking plumbing

Shift everyone to dematerialized securities:

“securities entitlements” not direct property,

omnibus accounts,

central CSDs – DTCC, Euroclear, Clearstream etc.

Post-GFC bail-in / resolution regimes:

TLAC/MREL,

“no more taxpayer bailouts”,

but legal priority for CCPs, secured creditors, systemically important intermediaries.

Cross-border “Key Attributes of Effective Resolution” pushed by Financial Stability Board.

Net effect: in a big crisis you can legally grab the pool at the CSD/CCP level and leave end-users with “entitlements” that get haircut/converted.

Build the digital rails that are numeraire-agnostic

High-availability cloud, ID, KYC/AML rails (MSFT/PLTR/etc.).

CBDC experiments (retail & wholesale) at European Central Bank, People’s Bank of China, etc.

Tokenized securities, tokenized “gold” by banks/AMs.

Multi-CBDC / cross-border platforms (mBridge-type).

Those rails don’t care whether the system’s deep collateral is “USTs” or “revalued gold”. They just need something on the balance sheet.

Normalize gold as a reserve asset again (without saying “gold standard”)

Official language shifts from “barbarous relic” to “important diversifier”.

More CBs disclose rising gold share of reserves.

World Gold Council data showing record net CB purchases.

Euro system quietly marks-to-market gold every quarter; no one in mainstream cares.

Weaponize the dollar/austere regime just enough to push others toward gold

Maximal use of sanctions & reserve seizures (Russia reserves, etc.).

Tightening cycles and QT to “fight inflation”, raising global funding stress.

EM/BRICS feel dollar risk, start diversifying reserves into gold.

This is exactly the “set the table before the Debt/Liquidity accident” phase.

Phase B — Accident + Great Taking

This is the Debt/Liquidity under-injection → accident → patch, but with the Great Taking machinery switched on.

We’d see:

A big refinancing/funding accident

Sovereign or quasi-sovereign refi wall meets “higher for longer” & QT.

Bond vigilante/FX panic / bank wobble / CCP issue.

Rapid move into “resolution” mode

Trading halts, gates on redemptions.

Key ETFs/pooled products suspending creations/redemptions or switching to cash-only.

Regulators talk “orderly resolution”, “avoiding runs”, “fair burden-sharing”.

Use of bail-in / resolution law on securities and funds, not just banks

Senior unsecured, hybrids, fund units, maybe even ETF units treated as loss-absorbing.

Legal language: “securities entitlements”, “pro rata”, “resolution vehicle”.

You get:

frozen positions,

haircuts,

conversion into long-dated sovereign paper or CBDC units.

Core: custodial paper gets sacrificed, underlying assets are moved to “resolution vehicles” controlled by states/CBs.

Gold inside the system is grabbed as “systemic collateral”

Gold backing major ETFs / unallocated accounts is pledged or re-titled to CBs/sovereigns/CCPs “to maintain financial stability”.

ETF holders get:

cash at some “stabilization price”,

or gold-linked CBDC claims with caps/conditions,

not actual bars at Freegold prices.

That’s the Great Taking sweep.

Phase C — Freegold Turn (Revaluation + New Regime)

Only after they’ve swept enough collateral would the Freegold part go live.

Signs:

Gold price allowed or forced to gap much higher

Sudden regime shift:

futures margin/collateral rules changed,

CBs signal they won’t sell, maybe will even buy,

paper-gold shorting channels constrained.

Could be:

“freeing” gold markets (no more covert suppression), or

open revaluation (official floor or auction).

CB balance sheets quietly recapitalized via mark-to-market gold

Eurosystem already does this mechanically.

Others start revaluing reserves, or at least speak more openly about gold’s role.

Sovereigns can:

issue gold-linked paper to other CBs/SWFs,

borrow against gold collateral,

show huge asset-side buffer vs nominal debts.

Gold integrated into sovereign settlement/protocols

CBs begin using:

allocated gold swaps,

tokenized inter-CB gold claims,

“gold as part of settlement basket” between blocs (BRICS, GCC+Asia, etc.).

Public language:

“diversified, real-asset-backed reserves”,

“more resilient monetary architecture,”

never “gold standard”, but functionally, gold is the final backstop between blocs.

Retail is pushed into fiat/CBDC rails, not physical gold

Taxes, reporting, KYC, windfall profit measures.

Easy on-ramps from old assets → CBDC/fiat; very annoying on-ramps → physical.

Gold ETFs may come back as “gold-linked index claims” but with no meaningful in-kind redemption.

Narrative wrapper

“We’ve learned from past crises; we’re anchoring the system in real assets.”

“Your digital money is safer because it’s backed by diversified reserves including gold.”

The losses from Great Taking are memory-holed as “necessary restructuring”.

That’s Freegold in practice: gold as high-priced, state-held SoV; fiat/CBDC for daily life; most private paper claims neutered in real terms.

Scoreboard: which of these signs do we already see?

I’ll break into buckets and grade:

GREEN = strongly consistent with Freegold arc

YELLOW = ambiguous / multi-use

RED = actively inconsistent

A) Central bank gold behavior & accounting

What Freegold wants:

CBs accumulate and mark-to-market gold, don’t sell; shift language from “relic” to “reserve diversifier”.

Reveals we actually see:

Record/near-record CB net purchases in 2022, 2023, 2024 (≈1,000+ tonnes/year), led by EM/BRICS and some “mystery buyers”.

Major holders (US, eurozone, Russia, China, etc.) are not net sellers.

Eurosystem explicitly marks gold to market quarterly on its balance sheet – exactly the ANOTHER-style architecture.

Narratives from the likes of International Monetary Fund / Bank for International Settlements increasingly call gold “an important part of diversified reserves”, not a relic.

Multiple CBs have repatriated gold from foreign vaults over the last decade (Germany, Netherlands, etc.) to domestic vaults.

Score: GREEN+

This is almost exactly what you’d expect in Phase A. Even if you don’t assume a Freegold plan, revealed preference screams “we want more bullion in our own vaults, we will carry mark-to-market volatility, we like this asset.”

B) Dedollarization / multi-polar reserve moves

What Freegold wants:

Enough discomfort with USD that blocs converge on a neutral Store-of-Value; gold is the only thing all blocs can live with publicly.

Reveals:

OBVIOUS US use of sanctions & reserve seizures (e.g., Russian FX reserves freeze) broadcast to the world: “your dollar assets are subject to our politics”.

I aldready covered why this is theater in my One World Government article.

BRICS+ rhetoric on:

trading in local currencies,

exploring alternative settlement units,

building systems like CIPS, mBridge, etc.

EM CB portfolios gradually increasing gold share and marginally reducing USD share.

Gulf/Asia deals with hints of non-USD settlement, sometimes linked implicitly to commodities.

Score: GREEN

You don’t need Freegold to explain dedollarization, but dedollarization + record CB gold buying is precisely the combination you’d expect if they’re moving toward “USD less dominant, gold quietly more central”.

C) Custody & legal architecture (Great Taking scaffolding)

What Great Taking wants:

Dematerialized assets held via securities entitlements in omnibus accounts at CSDs.

Bail-in / resolution laws that put CCPs and secured creditors ahead of beneficial owners in systemic crisis.

Cross-border harmonization so they can do this in a coordinated way.

Reveals:

Post-GFC reforms:

Widespread bail-in regimes in US/EU/UK (Dodd-Frank, BRRD, etc.).

TLAC/MREL for banks; loss-absorbing layers that can be written down.

Securities law language (e.g. in US’s UCC revisions, EU settlement regulations) treats you as:

holder of a securities entitlement,

not direct owner of a particular share/bond/bar.

Centralization of custody in CSDs and sub-custodians; retail always several steps removed from the root.

Cyprus bail-in, CoCo write-downs (e.g. Credit Suisse AT1 wipeout) – small glimpses of “we will torch certain classes to save the system”.

Score: GREEN / YELLOW

Even without conspiratorial intent, regulators have clearly built a world where:

Systemic stability trumps small-holder property rights in crisis.

The legal form of your “ownership” is ideal raw material for a Great Taking sweep.

This as pre-wired expropriation potential.

Feel free to read this 27 page document from the Financial Stability Institute (Bank for International Settlements), in which they map out a plan on how to steal your assets in a crisis.

This was published in July 2025.

The document explains how to best rug everyone to save the failing system because "financial stability is a key public good and using public resources as a last resort to enhance funding capacities appears only natural".

D) Gold market microstructure: physical vs paper

What Freegold wants:

A huge “paper gold” stack sitting inside the very custody system that Great Taking can sweep.

Eventually, a decoupling where physical is scarce and valued higher, paper claims are cash-settled or frozen.

Reveals:

Large and complex paper stack:

COMEX futures/options;

London unallocated accounts via bullion banks;

big ETFs (GLD, IAU, etc.) whose underlying bars sit in custody chains dominated by the same big banks and CSD infrastructure.

Most non-whale holders:

cannot redeem in kind,

own units in trusts/funds, not title to bars.

Persistent episodes of:

local premiums on physical in Asia,

stress in LBMA/COMEX (e.g. 2020 early-COVID transports/premiums).

Basel III NSFR provisions nudging banks away from unallocated bullion exposure (tilting toward fully allocated as “safer”).

Score: GREEN

The structure is almost comically aligned:

Physical mostly in system channels,

Retail’s “gold” mostly paper claims,

Legal & operational structure that lets you novate/settle those claims is convenient in a crisis.

We haven’t seen a durable, open decoupling yet (that would scream Phase C), but the setup is there.

E) CBDCs, ID rails, tokenization

What Freegold wants:

After the Great Taking + Freegold, they want maximum digital control of retail flows, while gold operates upstairs as sovereign SoV.

So they need:

CBDCs (wholesale + eventually retail),

strong ID/KYC rails,

programmable compliance.

Reveals:

Hardcore CBDC experimentation:

eCNY pilots at scale;

digital euro design work;

many smaller CB pilots.

Digital ID / KYC tightening everywhere:

travel rule,

FATF pressures,

EU’s NIS2/DORA, etc.

Tokenization buzz:

tokenized Treasuries, money-market funds, REPO, “tokenized gold” etc.

Integration of cloud/AI vendors (MSFT, PLTR, etc.) into state financial/plumbing projects.

Score: GREEN / YELLOW

They would be doing this anyway for control. But:

The more of this is in place,

the cheaper it is politically to run a Freegold-style reset:

you nuke old claims,

then say “look, clean CBDC system, new start, backed by diversified reserves incl. gold”.

F) Narrative & doctrine around gold and “resets”

What Freegold wants:

No open talk of Freegold; that would front-run the move.

But gradually:

“Gold important for CBs”,

“We need a more ‘balanced’ reserve system”,

“Reset”, “great reset”, “new financial architecture” as softening narratives.

Reveals:

Growing mainstream chatter about:

“de-globalization”, “new Bretton Woods moment”, “multipolar reserves”.

Gold:

more politely treated in official communications,

still not presented as anchor, but clearly not mocked.

Think tank / policy shop reports that flirt with:

“real assets”,

“resilient reserves”,

sometimes explicitly discuss higher optimal gold allocations for EM CBs.

Score: YELLOW / GREEN

Not decisive by itself, but doctrine has clearly moved from “gold = irrelevant” to “gold = serious reserve asset again”.

G) What we don’t see yet

There are several Phase C signs we do not see:

Open use of gold as settlement/collateral between CBs in a “new architecture” way.

Gold swaps and lending exist, but not as the headlining feature of a new regime.

Persistent, structural decoupling of physical vs paper price.

We’ve had episodes and local premiums, but not a visible, sustained “Shanghai 2x LBMA” type divergence that forces a regime rethink.

Large-scale, explicit use of resolution machinery to haircut ETF/fund holders in order to preserve system collateral.

Cyprus, CoCos, some bank resolutions are hints, but we haven’t seen “GLD-style vehicle gets gated, underlying bars pledged to CB, ETF holders stuffed with IOUs” yet.

Dominant public narrative that “gold saved the system” post-crisis.

We haven’t had the crisis that requires that story.

Where does that put us on the Freegold + Great Taking arc

I’d place us roughly here:

Stage 1–2: Pre-positioning + rehearsal

Already strongly underway:

CBs, especially EM/BRICS, have already shifted into a regime of structural gold accumulation.

Euro architecture already has the mark-to-market gold balance-sheet plug ANOTHER emphasizes.

Dollar system has already demonstrated it will “weaponize” reserves and FX plumbing.

Custody/legal/CCP resolution architecture for a Great Taking is already largely harmonized across US/EU/UK.

CBDC / ID rails are in the late pilot / early rollout stage.

Global sovereign debt-to-GDP is structurally high; refi walls are heavy over the next decade;

Developed-world fiscal deficits are large;

Inflation episodes post-COVID forced CBs to show “discipline” via rate hikes + QT theatre.

We already had tastes of:

UK Gilt/LDI,

US regional bank wobble,

euro energy/funding scares.

The Controllers have seen where plumbing nearly broke. They know the current regime is fragile; they’ve quietly grown the asset-side gold plug.

I’ve already covered how Central Banks deliberately cause crises by under-injecting liquidity.

Are they going to under-inject liquidity, to sacrifice the financial system to introduce CBDCs + Digital ID? Possibly.

More on why I think the Government created Bitcoin

This is an update to the article in which I’ll add some more things that make me think that the Government created Bitcoin.

1) Bitcoin as normative training sim for the cashless/CBDC era

I already explained how Bitcoin siphons gold demand, absorbs anger, becomes surveilled.

However, I didn’t cover BTC as a mass training program for the mental model the Controllers need before they can flip fully to CBDCs + no cash.

1.1. Training people to:

Hold non-physical “money” in something called a wallet

Accept irreversible transfers (“check three times before you send”)

Memorize or store seed phrases / keys

Understand addresses / QR codes as destinations

That’s exactly the UX pattern they need for CBDC + ID wallets. BTC/crypto make that architecture feel “normal” and even “cool” before the state version arrives.

1.2. Shifting the Overton window on what money is

Pre-BTC:

Money = notes/coins + bank account + card.

Post-BTC:

A big chunk of the population now accepts that:

“Money is just bytes”

“Monetary policy is code”

“Ledger entries = reality”

That’s perfect prep for:

“Here’s your CBDC wallet app, secured by hardware and cryptography. You already use MetaMask / Ledger / Binance, this is the grown-up version.”

BTC was the mass psychological onboarding to “purely digital, heavily programmable” cash.

1.3. BTC is the normative training sim and sandbox for the coming CBDC/cashless world

Concretely:

Cognitive/UX training

Wallets, addresses, QR, keys, irreversibility → all normalized in the wild.

Makes CBDC wallets feel like an upgrade, not a revolution.

Surveillance + legal rehearsal

Chain analytics, forensic chains of evidence, KYC/AML architectures,

Trials, precedents, inter-agency coordination,

All built under the banner of “crypto crime”.

Behavioral sorting

Majority chooses convenience and regulated custodians → easy to port into CBDCs.

Minority insists on self-custody → manageable leak.

Narrative positioning

“Look how dangerous and scammy the unregulated world is → you need our safe digital money.”

BTC’s worst moments become marketing for CBDCs.

Bridge into Freegold era

While gold is being quietly re-centered as sovereign plug,

BTC trains populations to live fully in “ledger space”,

so that when the Great Taking + Freegold + CBDC converge,

the behavioral friction is minimal.

You don’t need BTC to be originated by the Controllers for this to be true.

They just needed to:

Notice that BTC was:

excellent for telemetry,

excellent as an anger sink,

excellent as UX bootcamp,

Decide to spare and then shape its corridor,

And quietly build the CBDC + Freegold architecture on top.

BTC gave them:

normalized digital-scarcity mental models,

normalized “money = entries in a global ledger”,

normalized irreversible app-based flows,

normalized heavy KYC at digital-money on-ramps,

and a fully developed surveillance-analytics ecosystem.

CBDCs are just the state-branded version with:

guaranteed on-ramps,

integration into tax & welfare,

and gold at the back-end for the inter-sovereign tier.

2) Bitcoin as jurisprudential crowbar (new law categories)

I wrote about KYC, travel rule, Virtual Asset Service Providers (VASPs). I didn’t fully spell out BTC as a legal icebreaker for the whole coming tokenized world.

2.1. The Controllers needed a weird asset to expand:

“Virtual asset service provider” categories

Case law on:

whether digital assets are property, securities, commodities, money,

what counts as “constructive possession”,

when the state can freeze / seize keys or compel cooperation.

BTC is the test case that:

Lets them stretch AML/KYC/forfeiture architecture into totally new territory,

Then re-use it on:

tokenized securities,

stablecoins,

CBDCs,

tokenized gold,

everything that will live in the Great Taking rails.

2.2. BTC as pretext for “we must see everything on-chain”

Dark markets, ransomware, sanctions breaches → all the excuses they need to:

Legislate that on-chain surveillance is mandatory for Virtual Asset Service Providers (VASPs),

Build chain-analytics companies as semi-private deputized arms,

Normalize the idea that:

“if it’s on a public ledger, we are entitled to analyze and pattern-match it at scale.”

That’s not just about BTC. That’s about building a jurisprudential expectation that all digital rails are inherently analysable and surveillable — and that’s “public safety”, not overreach.

3) Bitcoin as R&D lab + mine-clearing for alternative monies

BTC/crypto is a giant outsourcing of R&D plus a map of what must never be allowed in official rails.

3.1. Let the crazies try everything, then copy or ban

Altcoins/DeFi/privacy-coins are:

A free feature-lab:

privacy defaults (Monero),

stablecoins,

Automated Market Maker (AMM) design,

collateralized lending,

Decentralized Autonomous Organizations (DAOs),

L2 scaling tricks.

The Controllers get, for free:

A live catalog of:

which primitives scale,

which ones create uncontrollable anonymity,

which patterns cause blowups,

which ones produce clean data exhaust.

Then they:

Bake the good bits into CBDCs and tokenized financial rails (efficiency, composability),

Mark the bad bits as forever taboo (“anonymous privacy coins”, “unlicensed mixers”),

Claim “open market experimentation proved X/Y/Z are unsafe — we must regulate them out”.

3.2. Mine-clearing competitors to ControllerCoin

The Controllers let BTC become the hegemon of “alternative money” and then:

Smother or criminalize serious private contenders (Monero),

Let only those alt experiments thrive that are:

easily surveilled,

dependent on centralized infra,

or obviously clownish.

BTC is the center of gravity that pulls oxygen away from any truly off-grid digital money scheme.

4) Bitcoin as geopolitical lever (Trojan reserve / insurgency rail)

The Controllers also get external leverage.

4.1. Trojan reserve asset for adversary states

If an adversary bloc ever seriously tries to:

run a “Bitcoin standard”,

hold BTC as major reserves,

route large-scale trade via BTC,

The Controllers have tools:

Mining chokepoints (energy, hardware, pools, export controls),

Regulatory shock events (“quantum FUD”, bans, sanctions on major providers).

Design goal: BTC looks like “digital gold for everyone” but is structurally dependent on:

a small fab set,

industrial energy contracts,

policy risk in a handful of countries.

That’s a great Trojan horse: let adversaries over-invest in something whose critical dependencies you can squeeze later.

4.2. Semi-deniable funding rail for ops

BTC gives IC/security cluster:

A rail for:

friendly non-state actors,